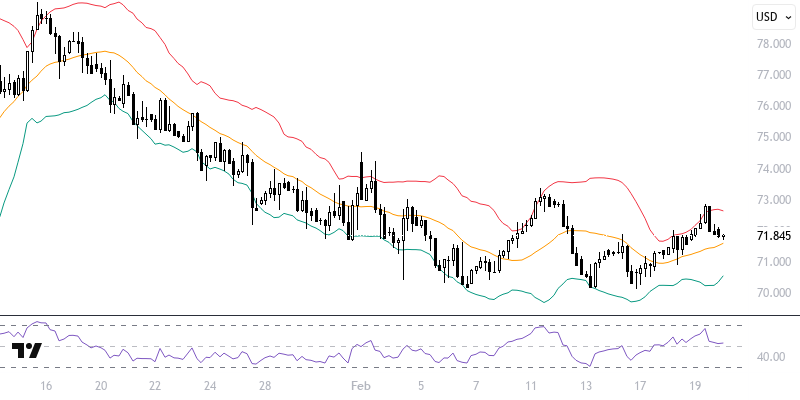

WTIUSD

Crude oil futures faced profit-taking following the American Petroleum Institute's report of a larger-than-expected increase in inventories. Last week saw a rise of over 9 million barrels, while this week's announced increase of 3.4 million barrels drew attention. It remains uncertain whether OPEC+ will increase production in April. Additionally, there has been no statement from Turkey regarding the resumption of oil trade from Northern Iraq. Ceasefire negotiations in Ukraine are also continuing in an unclear manner. Throughout the day, the status of European and US stock markets, along with the inventory figures to be announced by the US Energy Information Administration, can be monitored.

As long as prices remain below the 72.00 resistance, a downward trend may prevail. In potential declines, levels of 71.50 and 71.00 could be targeted. In recoveries, if the 72.00 resistance is not surpassed, new downside potential may arise. Therefore, movements and hourly closes above 72.00 will be crucial for the continuation of bullish sentiment. In this scenario, levels of 72.50 and 73.00 can be observed. The critical level for the day is set at 72.00.

Support :

Resistance :