WTI

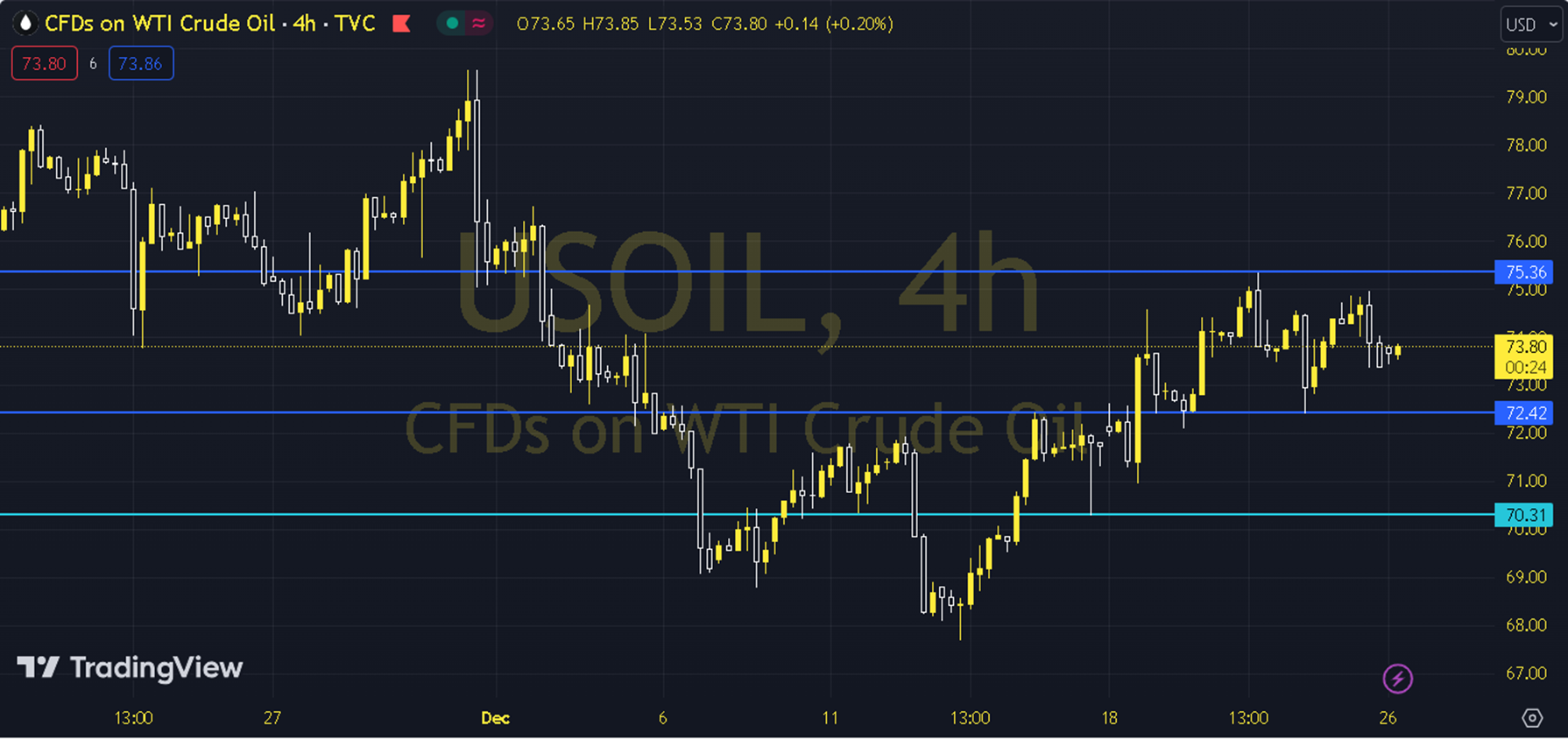

After the Christmas holiday, the markets entered the last week of the year, and oil prices saw limited pressure on the day they started with an increase. The trade tensions that were disrupted in the Red Sea are still high. The course of the US stock markets can be followed during the day. As long as the pricing remains below the 74.00 resistance in the upcoming period, a downward view may be at the forefront. In possible declines, the levels of 73.00 and 72.50 may be targeted. In this process, the attitude of the 73.00 region, which is supported by the 200-period exponential moving average, should be followed carefully. As long as the 74.00 resistance remains current in possible recoveries, a new downward potential may occur. Therefore, it may be necessary to see the course above 74.00 and hourly closings for the continuation of the upward desire. In this case, the levels of 74.50 and 75.00 may come to the agenda. Support: 73.00 Resistance: 75.00