'Bond King' gives up on US bonds

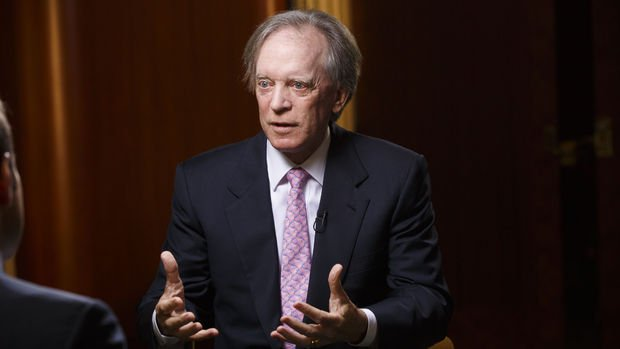

According to Pimco founder Bill Gross, known as the “Bond King” in the markets, 10-year US bonds with a yield of 4 percent are overvalued. Known as the “bond king” and having made millions of dollars from the bond rally that occurred last year by successfully predicting that the Fed would turn away from tight monetary policy, Pacific Investment Management Co. (Pimco) founder Bill Gross has now decided to stay away from US bonds. In a post he shared on his X account, Gross said that US 10-year bonds are “expensive” at a yield of 4 percent, and that if you absolutely want to buy bonds, inflation protected instruments (TIPS) with a yield of 1.8 percent with the same maturity would be a better choice. In a second post, Gross stated that it would be more logical for those interested in the market to invest in short-term bonds and wrote, “Stay committed to the return to a positive 10-year/2-year yield curve. While you wait, ‘carry’ provides gains.” The yield on US 10-year bonds is approximately 35 basis points below the yield on 2-year bonds. The yield curve has been inverted since July 2022, which some economists interpret as a sign of a recession. Investors began predicting last year that the curve would begin to revert.