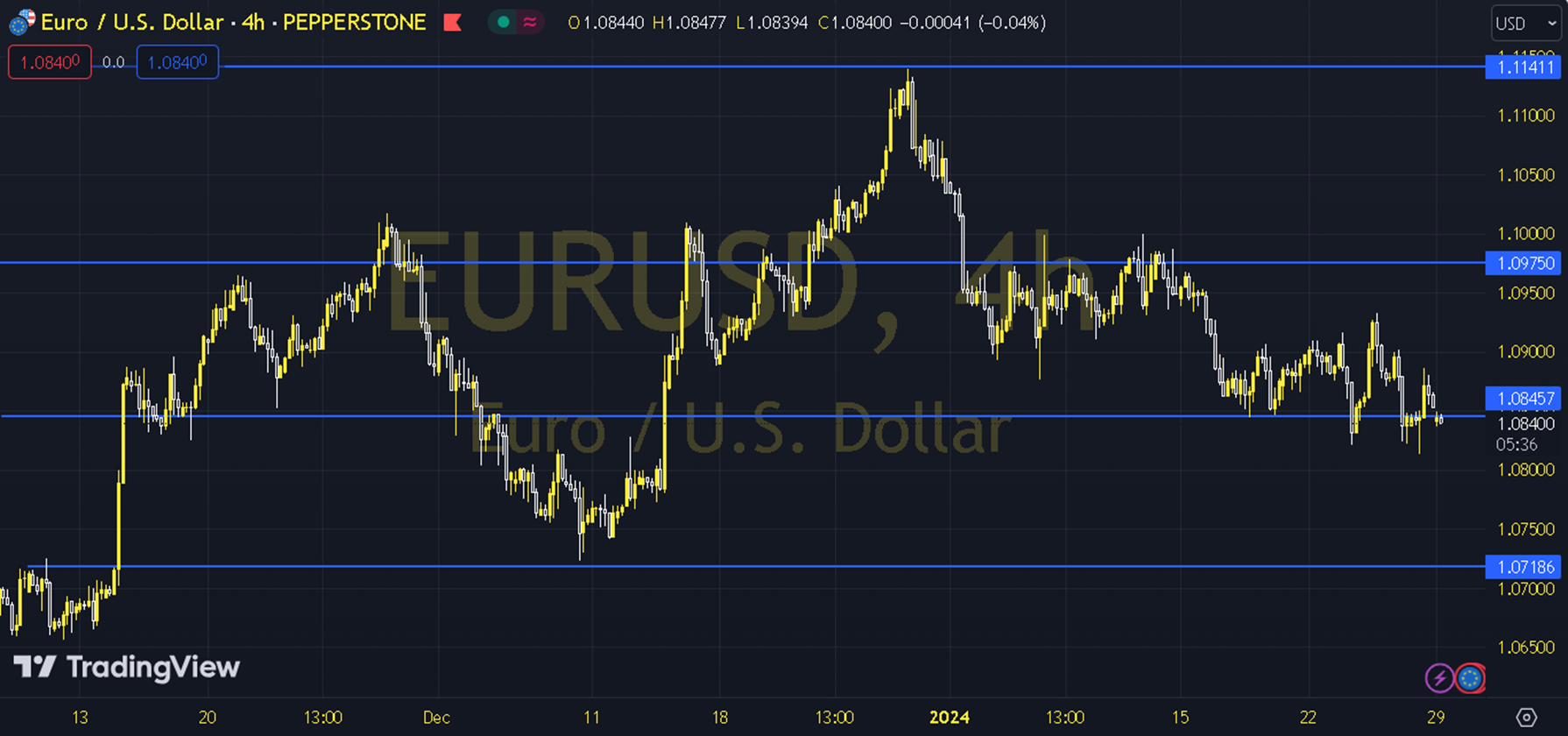

EURUSD

For EURUSD, the decisions of 2 important central banks (Fed and BoE) in the new week, PMI for the Services and Manufacturing sectors, Euro Zone CPI and US Non-Farm Employment will be the main macro headings we need to focus on. When we evaluate the EURUSD parity in the short term, the 55-period exponential moving average (1.0882) is important, although there are certain stretches, the desire of the Dollar Index to remain in the positive region has also caused the EURUSD parity to gradually create a negative performance. With this in mind, it may want to decline towards the supports of 1.0805 and 1.0755. The level of 1.0755 is a negative expectation. In the event of a possible recovery, it should not be forgotten that permanent movements above the average (preferably daily closing) are needed for the current scenario regarding the parity to be considered invalid. Support: 1.0820 – 1.0755 Resistance: 1.0910 – 1.1015