Stem Inc. Adjusts Strategy Amid Lower Q3 2024 Revenue

Stem Inc. (STEM) disclosed its financial results for the third quarter of 2024, revealing a decline in revenue primarily due to a decrease in hardware resale alongside a strategic shift towards software and services. The conference call, led by interim CEO David Buzby and CFO Doran Hole, outlined a refined business model designed to achieve sustainable revenues and profitability. Despite the decline in revenue, the company reported improvements in gross margins and a significant increase in Annual Recurring Revenue (ARR).

Key Points:

- Stem Inc. reported $29 million in revenue for Q3 2024, reflecting a decrease compared to the previous year.

- The GAAP gross margin was 21%, while the non-GAAP gross margin reached a record high of 46%.

- The company recorded over $100 million in accounts receivable impairment from previous hardware warranties, but does not anticipate further negative impact.

- Revenue guidance for 2024 has been reduced to a range of $135 million to $155 million, with progress in the software and services segments.

- Adjusted EBITDA and order forecasts have been downgraded, with orders expected to be between $100 million and $500 million.

- The strategic focus has shifted towards software and services for more predictable growth and higher margins.

- The company plans to reduce operating expenses by approximately 15% by the end of the year.

Company Outlook: Stem Inc. is expecting generally lower revenue with more predictable growth and higher gross margins in the future. The company is transitioning to shorter-term contracts to align with a strategy that emphasizes software over hardware. A search for a new CEO is ongoing, with a conclusion expected by the end of 2023. Updated guidance for 2025 will be provided in the fourth-quarter earnings call.

Negative Highlights:

- Significant financial adjustments included a $100 million impairment and a $5.6 million revenue adjustment.

- Revenue guidance for 2024 was lowered due to delays in storage hardware sales.

Positive Highlights:

- Software revenues grew by 10% quarter-over-quarter and 19% year-over-year.

- Service revenue reached a record high of $22 million, marking a 33% year-over-year increase.

- ARR saw an increase of over $3 million in the third quarter.

Below Expectations:

- The company reported a decline in revenue of $29 million for Q3 2024 compared to the previous year.

Q&A Highlights:

- The company will continue to focus on both hardware and software in its orders until the end of the year.

- Despite the shift to shorter contract durations, annual revenue expectations largely remain unchanged.

- Details regarding the conversion from Contracted Annual Recurring Revenue (CARR) to Annual Recurring Revenue (ARR) will be discussed in future reports.

- More details on storage software activations and ARR projections will be provided in the full-year report.

InvestingPro Forecasts: While managing its strategic shift towards software and services, recent InvestingPro data provides additional context regarding the company's financial condition and market performance. According to InvestingPro, Stem has a market capitalization of $67.16 million, reflecting the significant challenges the company faces. Revenue for the last twelve months as of Q2 2024 was $360.63 million, with an alarming revenue growth decline of 13.16% during the same period. This aligns with the reported revenue decrease and reduced guidance for 2024.

InvestingPro Insights highlight that Stem is "rapidly consuming cash" and may "struggle with debt interest payments." These forecasts support the company's strategic decision to focus on higher-margin software and services, alongside its plan to reduce operating expenses by 15% by year-end.

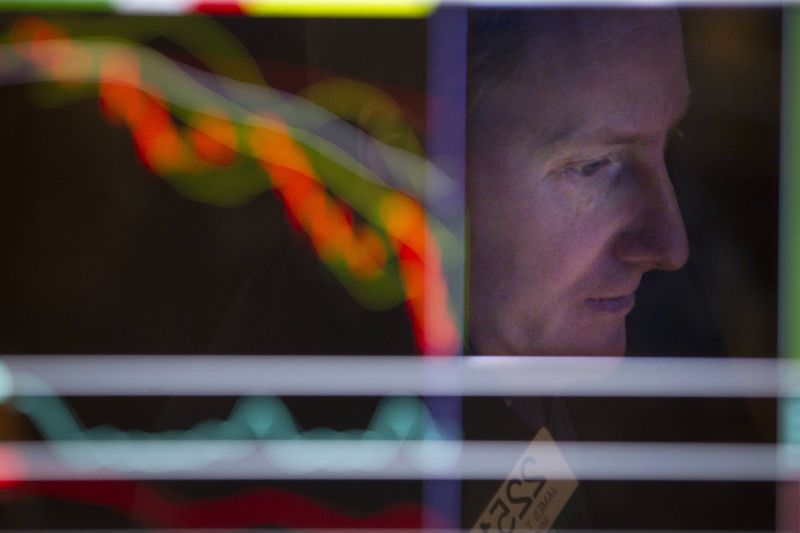

The stock's performance has been quite volatile, with InvestingPro data showing a 73.83% price decline over the last six months. However, there is a glimmer of hope with a strong 38.28% return in the last month, likely reflecting investors' optimism regarding the company's strategic shift.

Investors should note that analysts do not expect the company to be profitable this year, consistent with its focus on transforming its business model for future sustainability. The company’s price-to-book ratio of -0.39 further emphasizes the financial challenges it faces.

For those interested in a deeper analysis, InvestingPro provides 20 additional insights on Stem Inc., offering a comprehensive view of the company's financial health and market position.