Simon Property Group Reports Strong Q3 Performance in Earnings Call

Recently reported results show that Simon Property Group (NYSE: SPG) delivered strong financial and operational performance in the third quarter of 2024. CEO David Simon and CFO Brian McDade reported a real estate funds from operations (FFO) of $3.05 per share, an increase of 4.8% year-over-year, and a dividend increase to $2.10 per share, reflecting a 10.5% year-over-year rise.

Despite a non-cash loss related to Klépierre convertible bonds affecting FFO, the company maintained strong occupancy rates and leasing momentum by signing 1,200 lease agreements. The company reaffirmed its full-year guidance and highlighted a robust $4 billion development and redevelopment pipeline focused on mixed-use opportunities and enhancing property quality.

Key Points:

- Real estate FFO increased to $3.05 per share, up 4.8% year-over-year.

- Dividend rose to $2.10 per share, a 10.5% annual increase.

- Occupancy rates for malls and outlets reached 96.2%.

- The company signed 1,200 lease agreements covering 4 million square feet in the quarter.

- Simon Property maintains a strong balance sheet with $11.1 billion in liquidity.

Company Outlook:

- Full-year guidance for FFO reaffirmed between $12.80 and $12.90 per share.

- A $4 billion development and redevelopment pipeline focused on mixed-use opportunities was emphasized.

- OPI contribution is expected to be negative between $0.05 and $0.10 per share for the year but will be balanced by improving real estate performance.

Negative Highlights:

- Third-quarter FFO decreased compared to last year, primarily due to a non-cash loss from Klépierre convertible bonds.

- OPI has been a drag on FFO, with negative contributions expected for the year.

Positive Highlights:

- The residential pipeline exceeds $1 billion, focusing on integrating retail and residential development.

- Management remains optimistic about sustaining mid-single-digit NOI growth in the coming years.

- Strong luxury retailer interest continues, with 75 new luxury deals signed.

Shortcomings:

- Despite strong overall performance, the company experienced a decline in FFO per share compared to last year.

Q&A Highlights:

- ShopSimon.com saw significant GMV growth and aims for enhanced logistics and retailer participation.

- Domestic NOI growth approached 5%, exceeding expectations of 3% for next year.

- Further guidance on 2025 NOI growth will be provided in February.

In summary, Simon Property Group demonstrated resilience in its operations and strategic focus, balancing challenges with growth opportunities. The company's commitment to developing its property portfolio and adapting to market demands signals cautious optimism for the future while maintaining a strong financial position.

InvestingPro Insights: Simon Property Group's strong performance in Q3 2024 is further underscored by significant metrics and forecasts from InvestingPro. The company's market capitalization is impressively at $62.92 billion, making it a leading player in the Shopping Center REIT sector. This aligns with the strong occupancy rates and leasing momentum mentioned in the earnings report.

Data from InvestingPro reveals that Simon Property Group achieved robust revenue growth of 7.42% in the last twelve months, along with an attractive gross profit margin of 82.13%. This financial strength is consistent with the company's capability to increase its dividend and maintain a significant development pipeline.

An InvestingPro Tip highlights that Simon Property Group has sustained uninterrupted dividend payments for 31 years, reaffirming its commitment to shareholder returns as evidenced by the recent 10.5% dividend increase. The current dividend yield stands at 4.85%, making it attractive for income-focused investors.

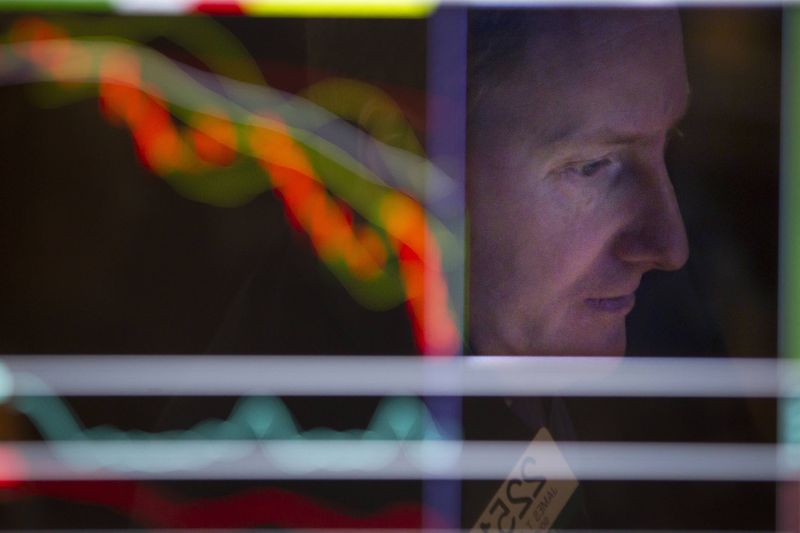

Another relevant InvestingPro Tip indicates that stock price movements have been quite volatile, which can be attributed to factors such as the impacts of Klépierre convertible bonds and the OPI contribution as noted in the earnings report.

For investors seeking a more comprehensive analysis, InvestingPro offers 8 additional tips related to Simon Property Group, providing deeper insights into the company’s financial health and market position.