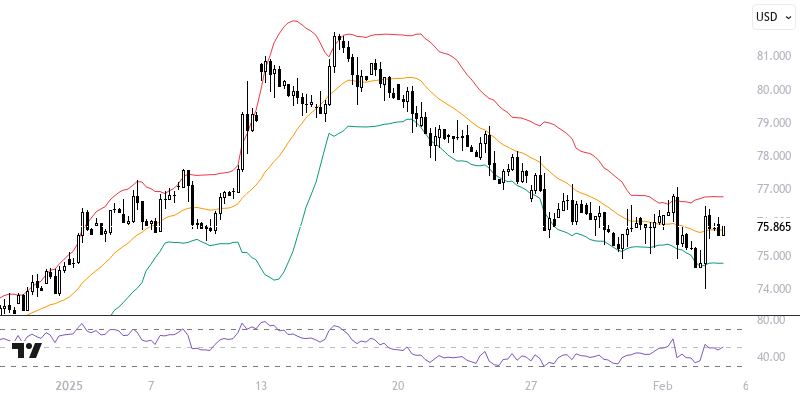

BRNUSD

Oil futures showed signs of recovery in line with Trump's statements aimed at completely halting Iran's oil exports and the more cautious trajectory of the tariff diplomacy between the U.S. and China. However, tariff decisions concerning China and OPEC+'s plan to gradually increase production for the second quarter continue to exert pressure on the markets. The American Petroleum Institute's report of a stock increase exceeding 5 million barrels has also impacted this scenario. Throughout the day, the movements of European and U.S. stock markets, along with the inventory data to be released by the U.S. Energy Information Administration, can be closely monitored.

As long as prices remain below the resistance level of 76.00 – 76.50, a downward trend may persist. In potential declines, the levels of 75.00 and 74.50 could be targeted. If prices move above the 76.00 – 76.50 resistance, levels of 77.00 and 77.50 may come into play. For the continuation of the upward momentum, closes above 76.50 are critically important.

Support :

Resistance :