GBPUSD

The ongoing general optimism above the 233-day exponential moving average (105.15) highlights a short-term reaction thought as it trades below the 34-day average (107.68). In light of recent developments, the classic Dollar Index has supported this notion by dropping below the 107 level. In an environment where the reactive process is expected to continue, the Retail Sales data coming from the U.S. should be monitored closely as the week closes.

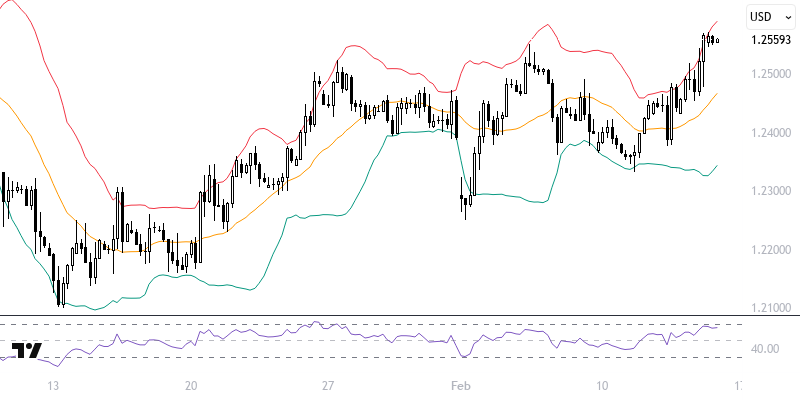

The GBPUSD pair continues its course above the 1.2420 – 1.2455 zone, where the 144 and 233-period averages are located, due to reactionary sales in the DXY. Positive Growth and Industrial Production data from the UK support a favorable outlook, potentially creating room for movement towards the 1.2715 barrier. Notably, the 1.2570 level should be watched carefully as a critical threshold to assess whether the upward trend will persist.

Support :

Resistance :