EURUSD

Despite the reactionary outlook starting from the 110 level, optimism continues in the medium-term Classic Dollar Index. In the weekly bulletin, we emphasized the critical importance of the range between 106.45 and 105.70, where the 21-week moving average is located. It is noteworthy that the index reached the 106.45 level in the middle of the week and is attempting to display a bottoming pattern in this area. We will continue to monitor whether the index can remain above this critical zone for the rest of the week. This raises the question of whether the upward trends in EURUSD and GBPUSD have come to an end.

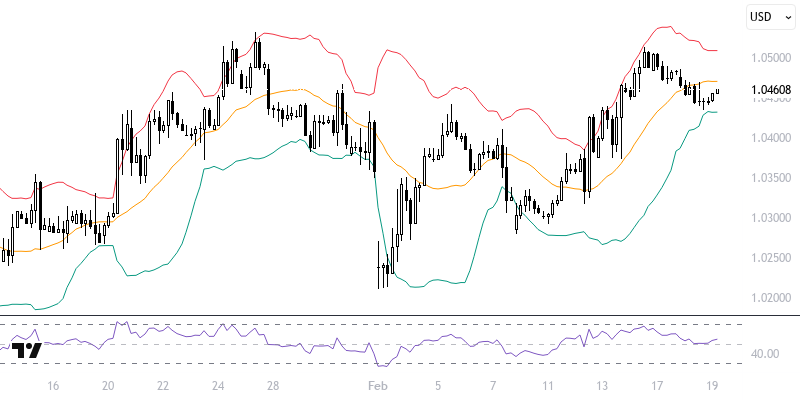

After the EURUSD pair rose above the 1.05 level, it came under pressure with the recovery in DXY. If the anticipated reversal in DXY occurs, downward pressures on the pair should be anticipated. From a technical perspective, sustained movements below the 1.0410 – 1.0430 range are needed for this pressure to develop. However, since a breakout has not yet occurred, the positive trend continues. For the positive movement to persist, a sustained situation above 1.0480 is expected. Key levels for the day are 1.0410 and 1.0480.

Support :

Resistance :