GBPUSD

Although there is a general optimism above the 233-day exponential moving average (105.20), the Classic Dollar Index trading below the 34-day average (107.40) emphasizes a short-term reaction thought. In this context, while closely watching how effective the reaction process of the index and currency pairs will be, the Service and Manufacturing PMI data coming from France, Germany, the Eurozone, the UK, and the US should be closely monitored. These data provide important leading signals regarding growth dynamics.

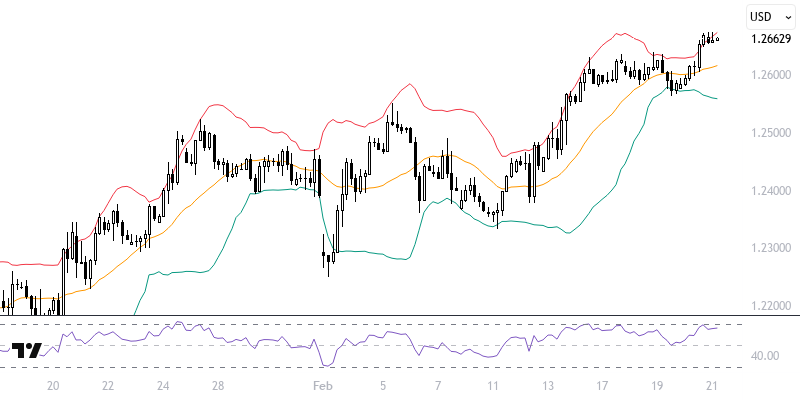

The GBPUSD pair maintains its short-term optimism with a reaction at the upper end of the 1.2570 – 1.2620 range. As long as the pair stays above the 1.2570 support level, it may continue to follow a positive trajectory. Expectations are increasing towards the levels of 1.2675, 1.2715, and 1.2760, while the status of 1.2810, the peak on December 6, 2024, is crucial in determining whether it is a reaction sale or a trend rally.

Support :

Resistance :