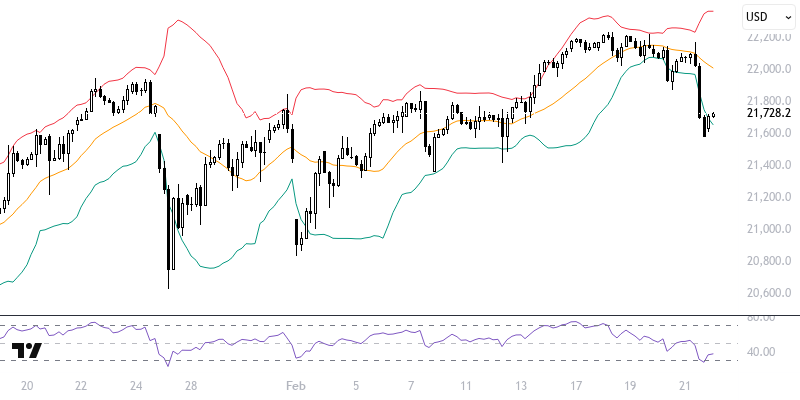

NDXUSD

The US PMI data released on Friday indicated signs of contraction as the services sector fell below the 50 mark. This situation heightened recession concerns in the US economy due to the significant impact of the services sector and led to an increase in 10-year bond yields. Despite this, the NASDAQ100 Index entered a downward pricing process, with sub-sectors such as semiconductors, software, and information technology being among the most affected.

The NASDAQ100 index is trading at critical levels supported by the indicators we monitor. In short-term pricing, the 89 and 233-period exponential moving averages located in the 21700 – 21900 range provide support. For a positive trend to continue, sustained pricing above 21900 is necessary. In potential recoveries, levels of 22000 and 22100 can be considered, with 22100 standing out as a critical threshold. For negative scenarios, it will be essential to maintain a position below 21700.

Support :

Resistance :