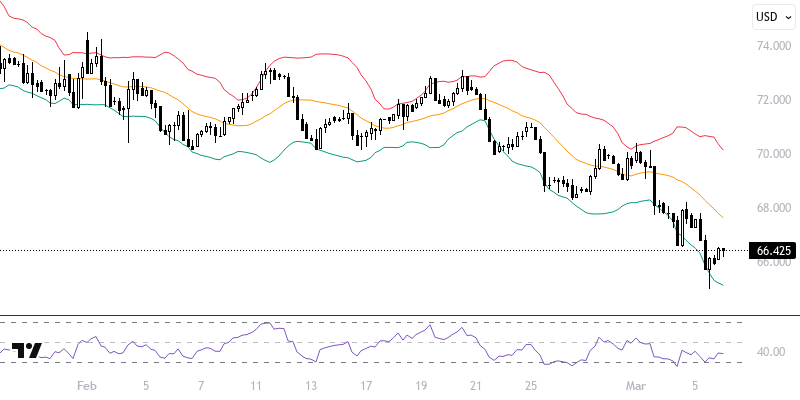

WTIUSD

Oil futures are exhibiting an upward trend following a corrective movement after effective losses. Key factors influencing this situation include rising stocks (3.6 million barrels), OPEC+'s gradual production increase plan, and speculation that the U.S. could ease sanctions on Russia. Trump's decision to suspend automotive transactions related to tariffs on Canada and Mexico for a month may also play a role in this correction. The performance of European and U.S. stock markets should be closely monitored throughout the day.

As long as prices remain below the 67.00 - 67.50 resistance level, a downward outlook may prevail. In potential declines, targets could be set at 66.00 and 65.50. If the 67.00 - 67.50 resistance is surpassed, a new upward potential may emerge, bringing the 68.00 and 68.50 levels into focus. The significant levels of the day are highlighted between 67.00 and 67.50.

Support :

Resistance :