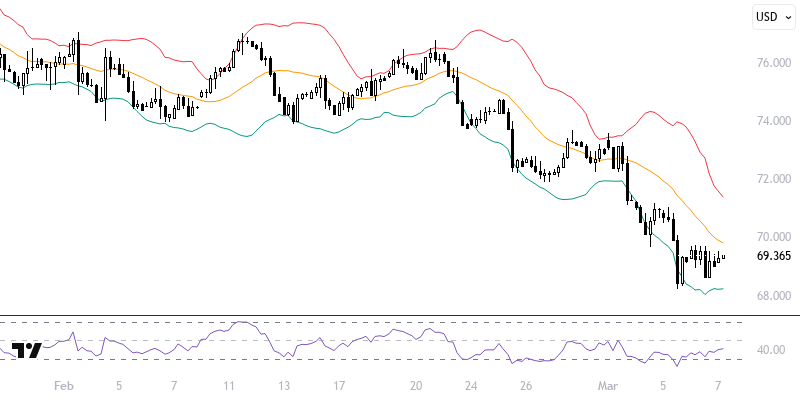

BRNUSD

Oil futures have been under pressure this week due to Trump's tariff policies and the stances of Canada and China against these policies. The news that OPEC+ will begin gradual production increases in April, along with the possibility of the U.S. lifting sanctions on Russia early, has also created uncertainty in the markets. While a balanced trend was observed during the Asian session, the movements of European and U.S. stock markets, as well as employment data in the U.S., are being closely monitored.

As long as prices remain below the resistance level of 69.50 – 70.00, a downward outlook may prevail. In case of potential declines, levels of 69.00 and 68.50 may be targeted. However, as long as the resistance at 69.50 – 70.00 is not breached, new potential declines could arise; thus, closings above 70.00 should be observed carefully.

Support :

Resistance :