EURUSD

Ahead of the Fed meeting on March 19, the U.S. inflation data for February has become a key agenda item in global markets. Following last week's employment data, market attention has shifted to potential changes in inflation. Global investors are analyzing the effects of Trump’s policies on asset prices while closely monitoring macroeconomic indicators that will shape the Fed's roadmap. The expectation of three rate cuts by the end of the year being priced in the swap market is critical in understanding the role of inflation data in this process.

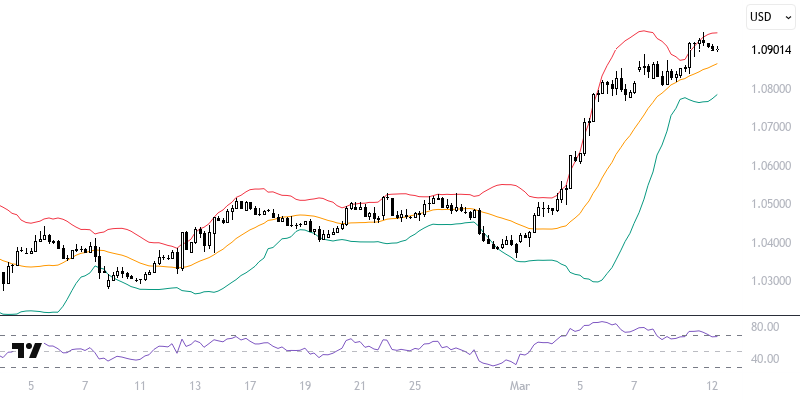

Recent declines in the Dollar Index are noteworthy; a fierce strategic battle will unfold between short-term sellers and medium-term buyers. The developments leading up to March 19 are significant for the index's impact on second-quarter forecasts. In the EURUSD pair, focusing on the range of 1.0760 – 1.0820 is vital for determining the direction of the pair.

Support :

Resistance :