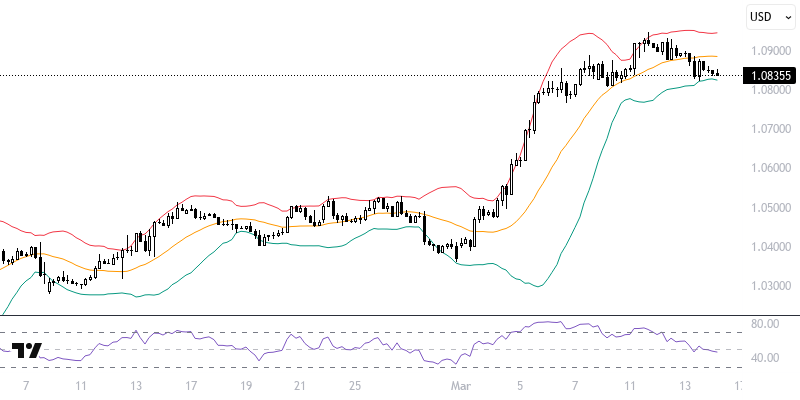

EURUSD

The negative impacts arising from Trump's tariffs have increased expectations for a Fed interest rate cut, while the U.S. inflation data also supports this process. The FOMC Economic Projections on March 19 and the messages from Fed Chair Powell will set our roadmap for the upcoming period. Today, with the week's close, growth data from the UK and the Michigan Consumer Sentiment alongside inflation expectations from the U.S. are awaited.

The classic Dollar Index is currently witnessing a struggle between short-term sellers and medium-term buyers due to recent fluctuations. The Fed's decisions on March 19 and the developments leading up to that date will provide significant interpretive ground for the second quarter of the year. Particularly, the EURUSD pair is moving at critical levels, with an important balance observed between the support point of 1.0760 and the resistance of 1.0870.

Support :

Resistance :