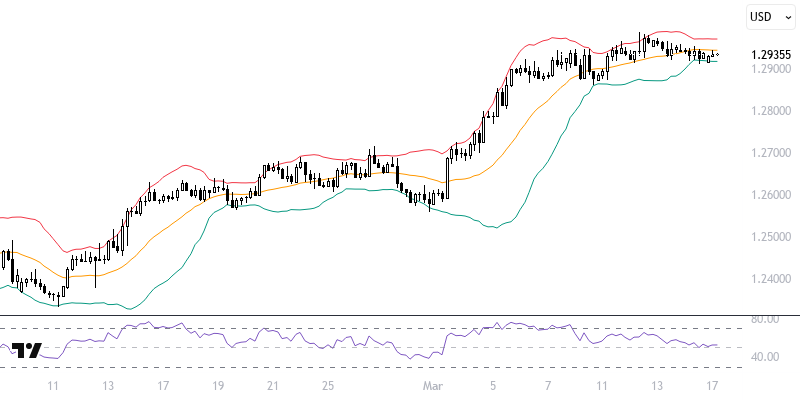

GBPUSD

In the new week, the main focus in global markets will be the decision made by the Fed. In this context, it should be noted that other developments, such as the meetings of the BoJ, BoE, and SNB, are also significant. Although no major changes in policy interest rates are expected, the hints provided by banks regarding the future are crucial for understanding the movements of local currencies against the US Dollar. Additionally, data such as Retail Sales from the US, ZEW Economic Sentiment from Germany, and CPI from Canada should be monitored.

The Dollar Index has shown fluctuations recently, indicating a conflict between short-term sellers and medium-term buyers. The impact of developments until March 19 is of great importance for the index in the second quarter of the year. Meanwhile, the GBPUSD pair shows short-term optimism above the 1.2855 level, which could create movement towards the 1.2945, 1.2990, and 1.3030 levels.

Support :

Resistance :