EURUSD

The Fed decisions starting this evening, along with potential revisions in economic projections and significant questions regarding market expectations, are at the center of the week. Whether interest rate cut expectations will be supported by the Fed, and President Powell's comments on risk definitions and the bank's strategy, will play a decisive role in the sudden reactions of asset prices. While a more dynamic process is expected tomorrow evening, today’s considerations also include the meeting between Putin and Trump, as well as data from Germany's ZEW Economic Sentiment and U.S. Industrial Production.

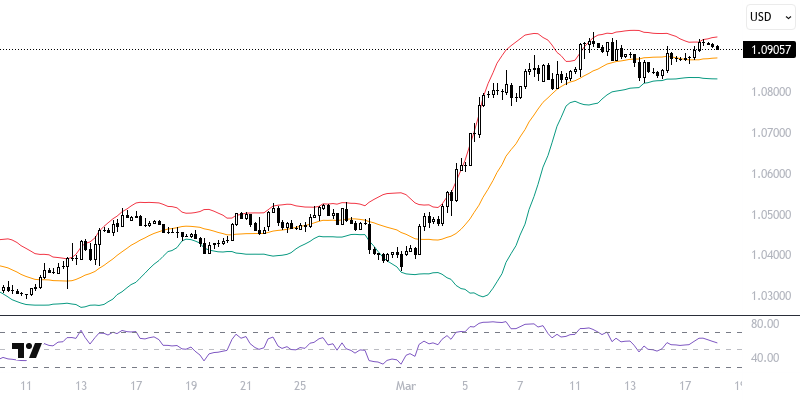

The Dollar Index is witnessing a struggle between volatility tendencies and short- to medium-term buyers. The impact of the March 19 Fed decisions is critical for the index in the second quarter of the year. While medium-term buyers remain optimistic above the 200-week average, short-term sellers are resisting below certain averages. The EURUSD pair's desire to stay positive in the 1.0760 – 1.0820 range is noteworthy, especially since the 1.0920 level serves as an important resistance point. These levels are crucial for a potential reaction sell-off or trend rally.

Support :

Resistance :