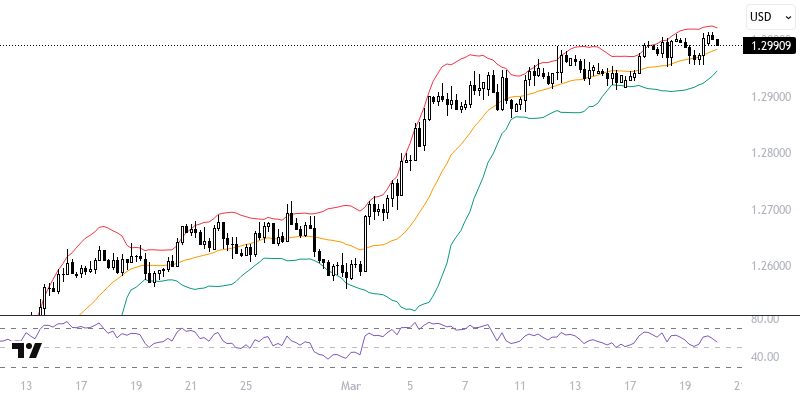

GBPUSD

The U.S. Federal Reserve (Fed) announced its highly anticipated interest rate decision, keeping the federal funds target rate between 4.25% and 4.50%. Notably, starting in April, the monthly sales of treasury securities will decrease from $25 billion to $5 billion. In its economic projections for 2025, the Fed revised its growth forecasts downward while adjusting PCE inflation and unemployment rates upward.

Fed Chairman Powell stated that they will monitor the labor market's condition to assess potential impacts on inflation. Following the Fed's decisions, the Dollar Index weakened, while an increase was observed in the EURUSD and GBPUSD pairs. Today, the decisions from the central banks of the UK and Switzerland are eagerly awaited. In particular, sustained movements above the 1.2945 level in the GBPUSD pair could help strengthen upward momentum.

Support :

Resistance :