XAUUSD

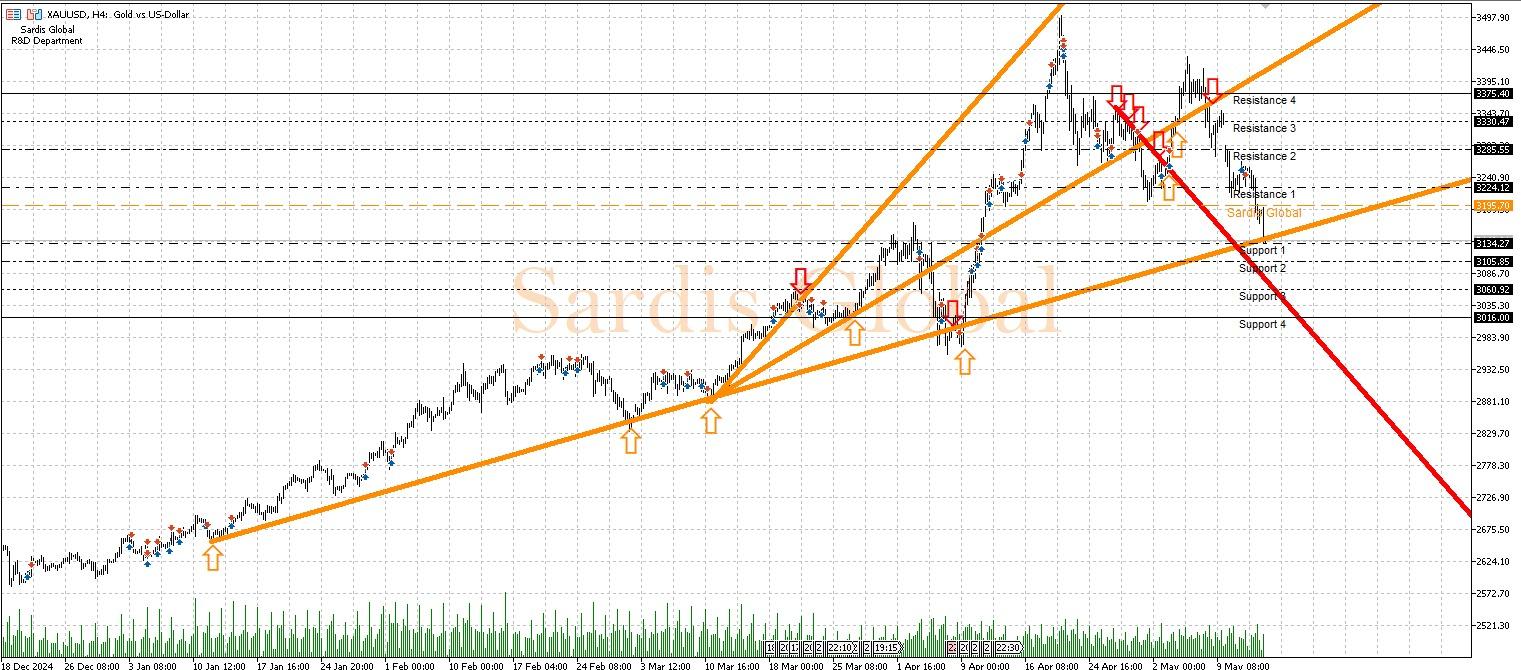

The gold price is under selling pressure due to the US inflation data aligning with expectations. The increased predictability regarding the Fed's interest rate cut path and the geopolitical risk premium provide support for the precious metal. The decline in US 10-year Treasury yields supports a negative real interest rate environment, creating favorable conditions for gold. The US retail sales data and the upcoming CPI announcement may influence short-term gold price dynamics. Strong consumer spending data could increase the likelihood of the Fed maintaining its tight monetary policy, putting pressure on gold. The pivot level of 3197.00 is critical from a short-term technical perspective. It is anticipated that selling pressure may continue in price actions below this level.

Support :

Resistance :