EURUSD

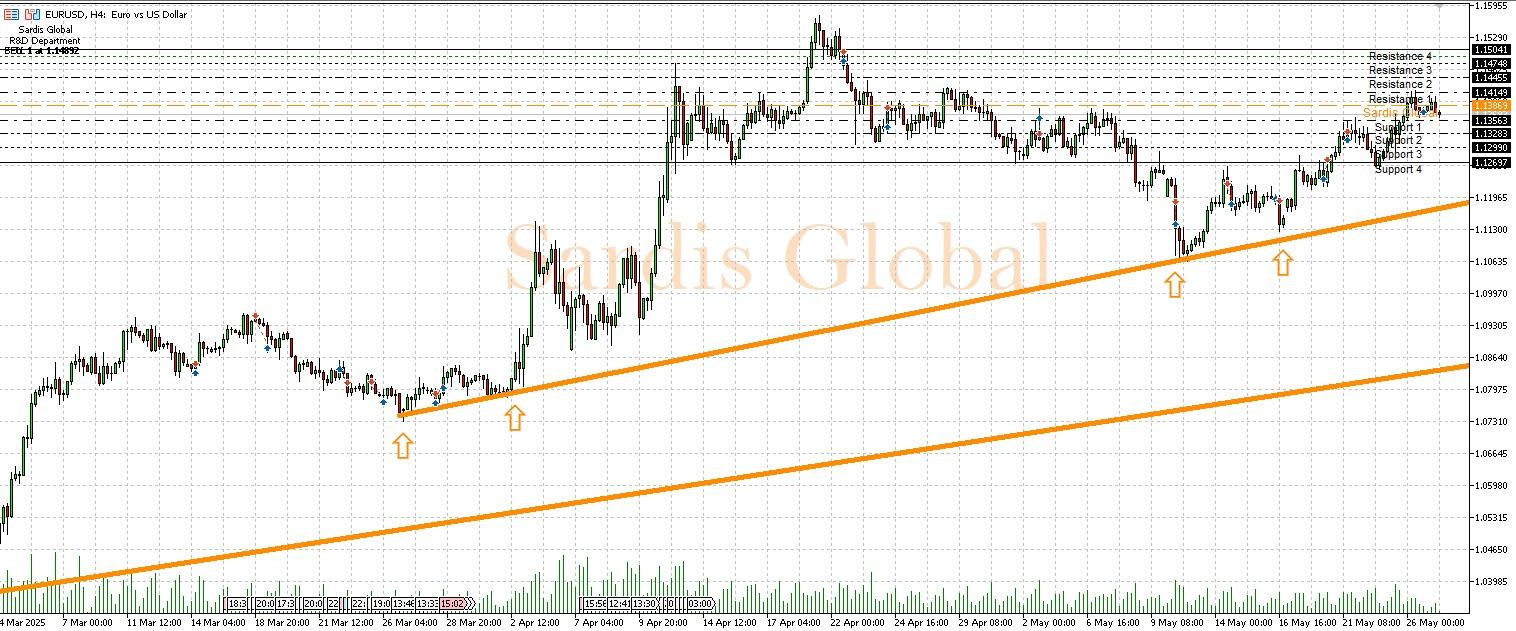

The EURUSD pair experienced a very low trading volume and limited volatility on Monday, the first trading day of the week, due to the holidays in the US and the UK markets. The main factors that will determine the course of the pair this week will be the influx of data from the US. Today's announcement of the CB Consumer Confidence (Expectation: 87.1, Previous: 86.0), the FOMC meeting minutes on Wednesday, Thursday's GDP (Expectation: -0.3%) and Jobless Claims (Expectation: 229K), as well as the Core Personal Consumption Expenditures (PCE) Index (Monthly Expectation: 0.1%) closely monitored by the Fed as an inflation indicator on Friday, will directly affect the strength of the dollar. The pivot level for the pair is critical at 1.13869. If strong US data and hawkish FOMC messages support the dollar, the support levels of 1.13563 (S1) and 1.13283 (S2) may be targeted. Conversely, weak data and dovish signals could push the pair to resistance levels of 1.14149 (R1) and 1.14455 (R2). The CPI data from Germany on Friday may also create volatility on the Euro side.

Support :

Resistance :