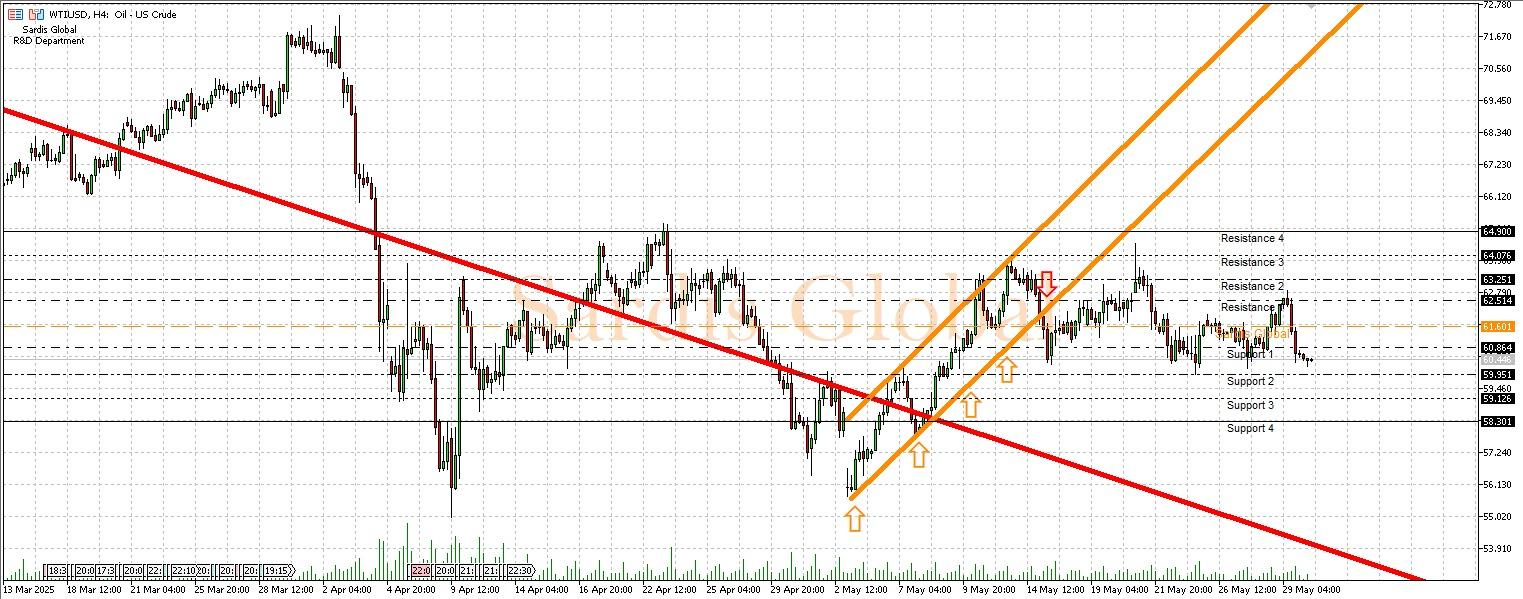

WTIUSD

Crude oil prices are significantly influenced by global growth expectations, OPEC+ decisions, geopolitical developments, and stock data that reflect the supply-demand balance. The crude oil stock data released yesterday provided new signals to the markets about the current supply situation and had an impact on prices, with stocks coming in at -2.795M while +1.000M was expected. While selling pressure may continue during price increases, today’s economic data from the U.S. will continue to affect oil prices, particularly through demand expectations. Technically, the 61.125 pivot level remains critically important. Above this level, upward movements may target resistances at 61.888, 63.620, and 64.868. In the case of continued or increased selling pressure due to the impact of yesterday’s stock data, support levels at 59.393, 58.630, and 57.383 will be closely monitored.