EURUSD

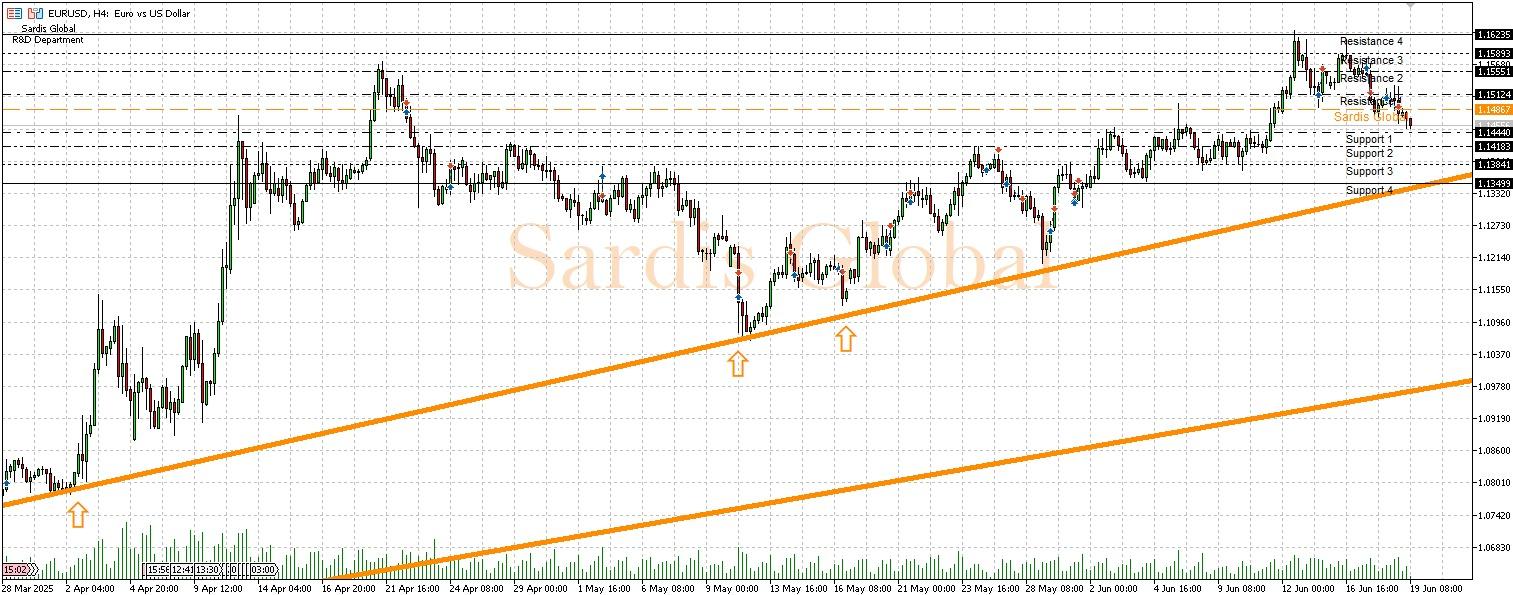

The FED meeting that took place yesterday and Chairman Powell's speech exhibited a more "hawkish" stance contrary to market expectations, as the central bank reduced the interest rate cut expectations for next year from two to one. This development has pressured risk appetite in global markets, leading to a significant strengthening of the Dollar Index (DXY) as the most important outcome. This situation creates a significant pressure factor across all asset classes, from major pairs to commodities and indices. The policy divergence between the European Central Bank (ECB) starting its interest rate cut cycle and the FED maintaining its tight stance increases downward pressure on the pair. Technically, pricing continues its weak trend by remaining below the pivot level of 1.14967. As long as it stays below this level, the selling pressure may continue, targeting support levels of 1.14440 and 1.14183.

Support :

Resistance :