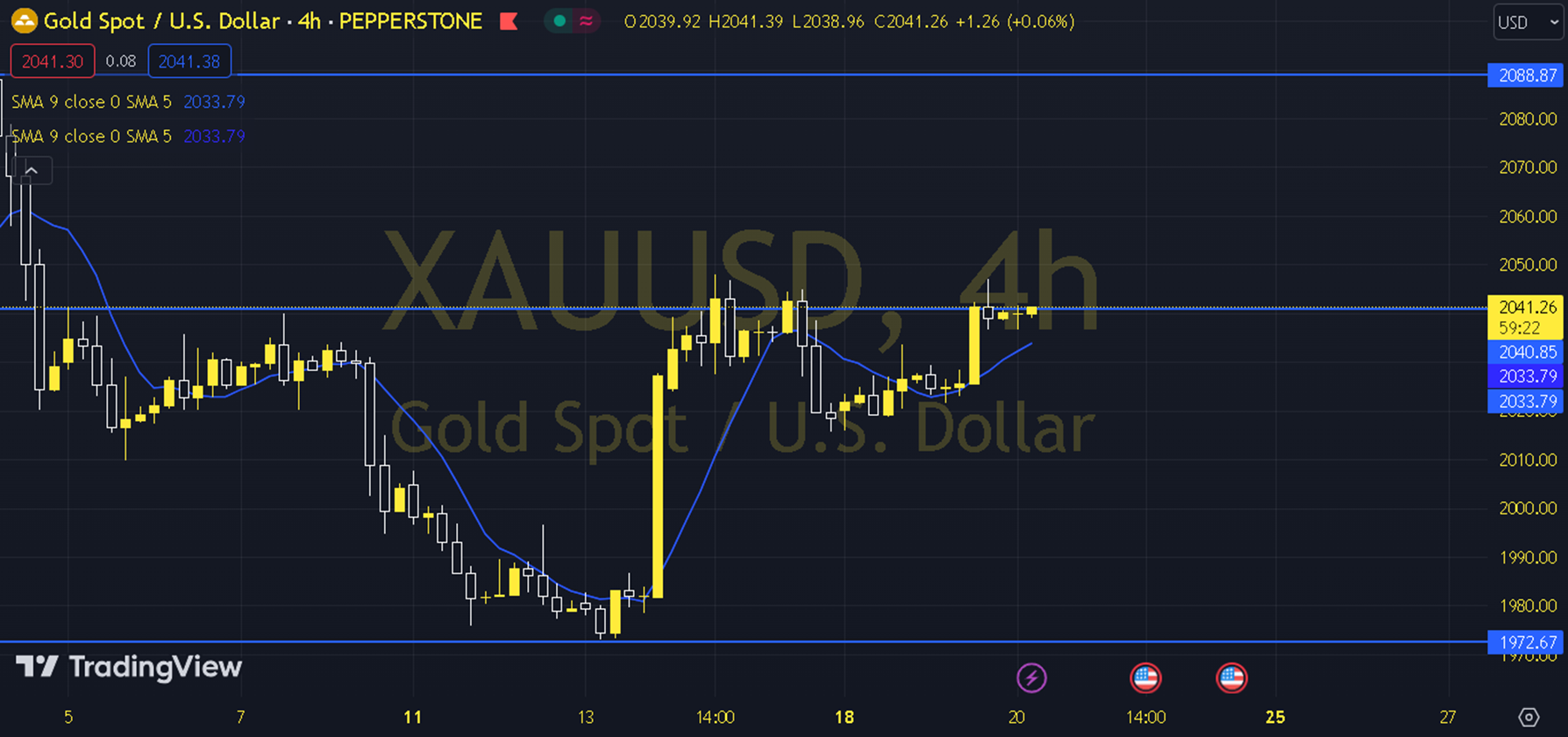

XAUUSD

The fact that the ONS Gold Dollar Index continues to move below the 102.00 - 102.35 region and the US 10-year bond interest rate continues below the 4.00 - 4.05 region highlights the expectation that the ONS Gold will accept the 2012 - 2021 region as the bottom and continue to rise above the 13 and 34-period average. While optimism about the precious metal continues ahead of Friday's critical US PCE Deflator data, we will follow the 2042 - 2052 region and intraday macro-economic developments to see whether this optimism is confirmed. If the precious metal can exceed the relevant region, the desire for an increase may become even stronger, and with this thought, a new rally towards the 2090 dollar level may be observed. Otherwise, a slight compression may be observed between 2052 - 2012. It should not be forgotten that in such a compression, positive expectations continue as long as we remain above the 2012 - 2021 region. Therefore, in order for our current scenario to be considered invalid, the condition of permanence under the lower region must be sought. However, in the event of such a change, pressure towards the 1969 - 1977 bottom region can be observed. Support: 2021-2012 Resistance: 2042-2052