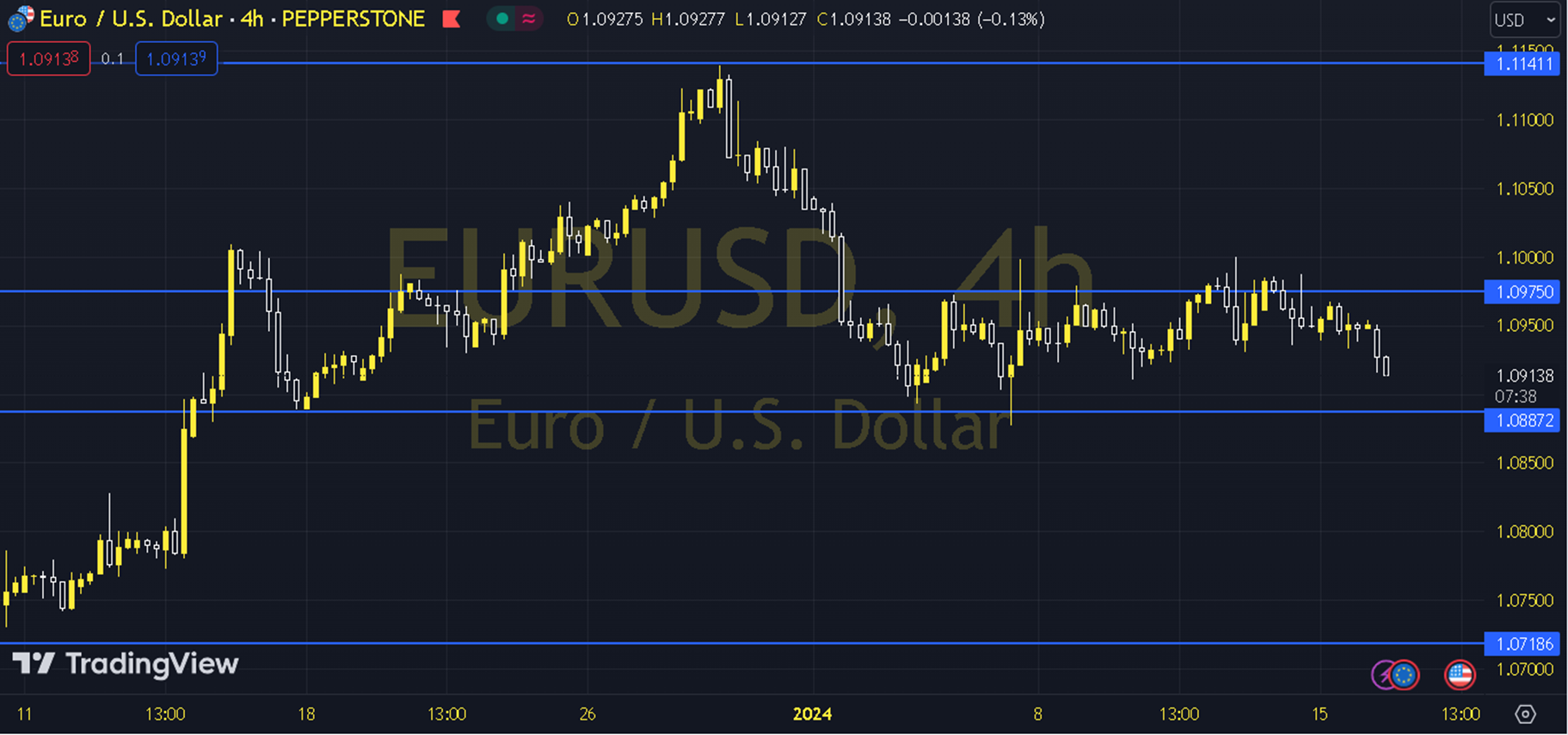

EURUSD

For EURUSD, today's CPI and ZEW Economic Sentiment from Germany, Manufacturing Index from the US and FOMC member Waller's speech can be explained as developments to watch out for. When we evaluate the EURUSD parity in the short term, it can be expected that the parity will adapt to the new negative outlook as long as the rise in the Dollar Index continues due to the end of the upward channel. Although the 1.0930 - 1.0965 region is important in terms of price, it can be observed that the pressure for the parity continues under the relevant region. With this in mind, a decline towards the supports of 1.0890, 1.0850 and 1.0805 can be seen. It should not be forgotten that in a possible recovery process, permanent movements are needed above the 1.0930 - 1.0965 region in order for the parity to return to the positive trend it ended. However, under this condition, a new expectation towards the 1.1145 peak may occupy the agenda. Support: 1.0850 – 1.0805 Resistance: 1.1090 – 1.1145