USDJPY

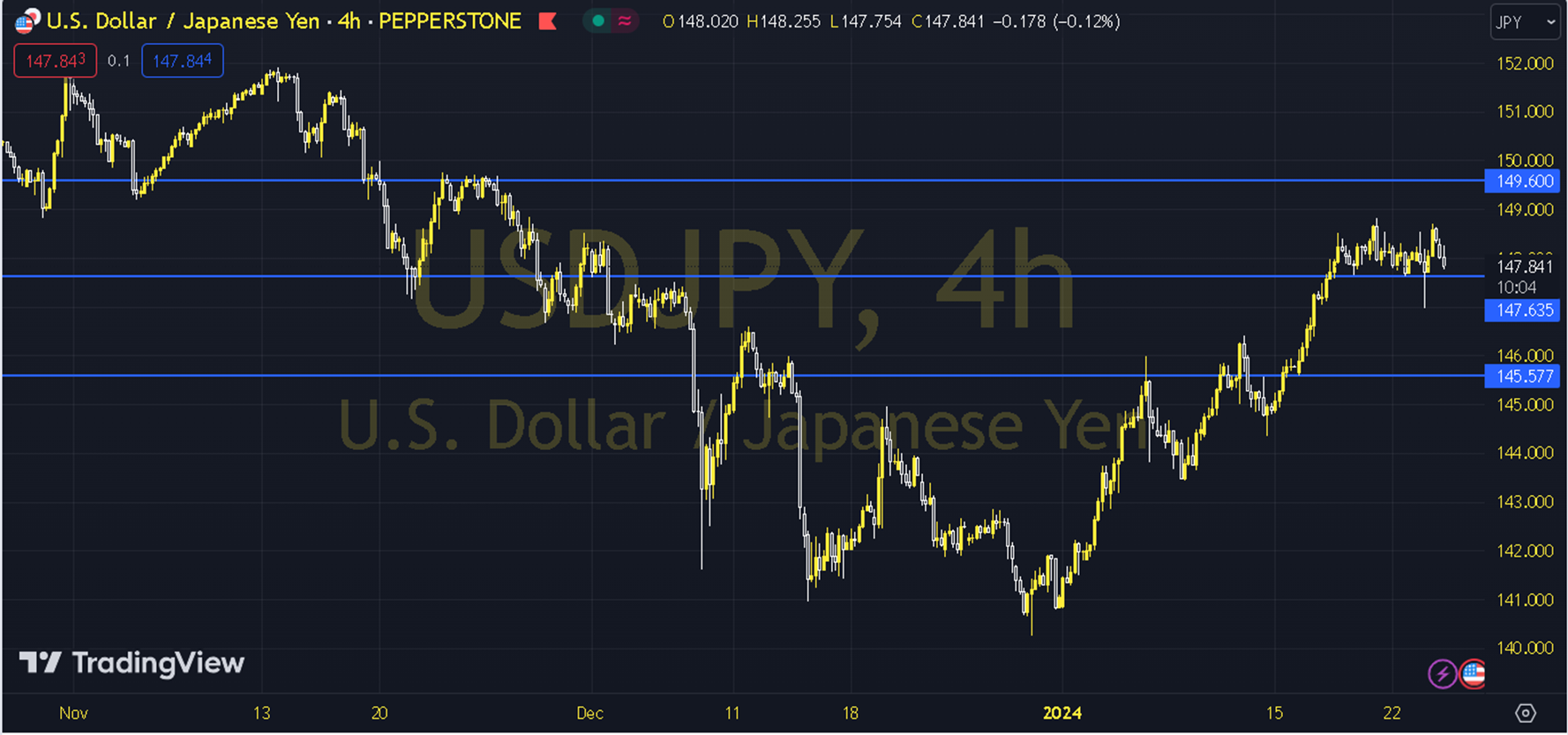

USDJPY Pair The increasing yield rates along with the sales in bonds in Japan are also causing interest expectations to increase. The 10-year bond yield increased by 11% to 0.71%. For the Classic Dollar Index, the 34-day average is 102.45, while for the US 10-year bond interest rate, the 233-day average is 4.02. Although it is important, it should not be forgotten that negative pressure continues as long as the reference indicators are not exceeded. This attitude may bring to the agenda the expectation that the possible reaction sale idea regarding the parities may remain limited. The USDJPY Pair continues to price above the 55-day period. The parity, which started the day with an increase, is pricing above its 200-day average. If the day closes above 149.600, the idea of a New Ath may come to the agenda. If there is a decrease, it is expected to reach 147.135. Support: 147.135 Resistance: 149.600