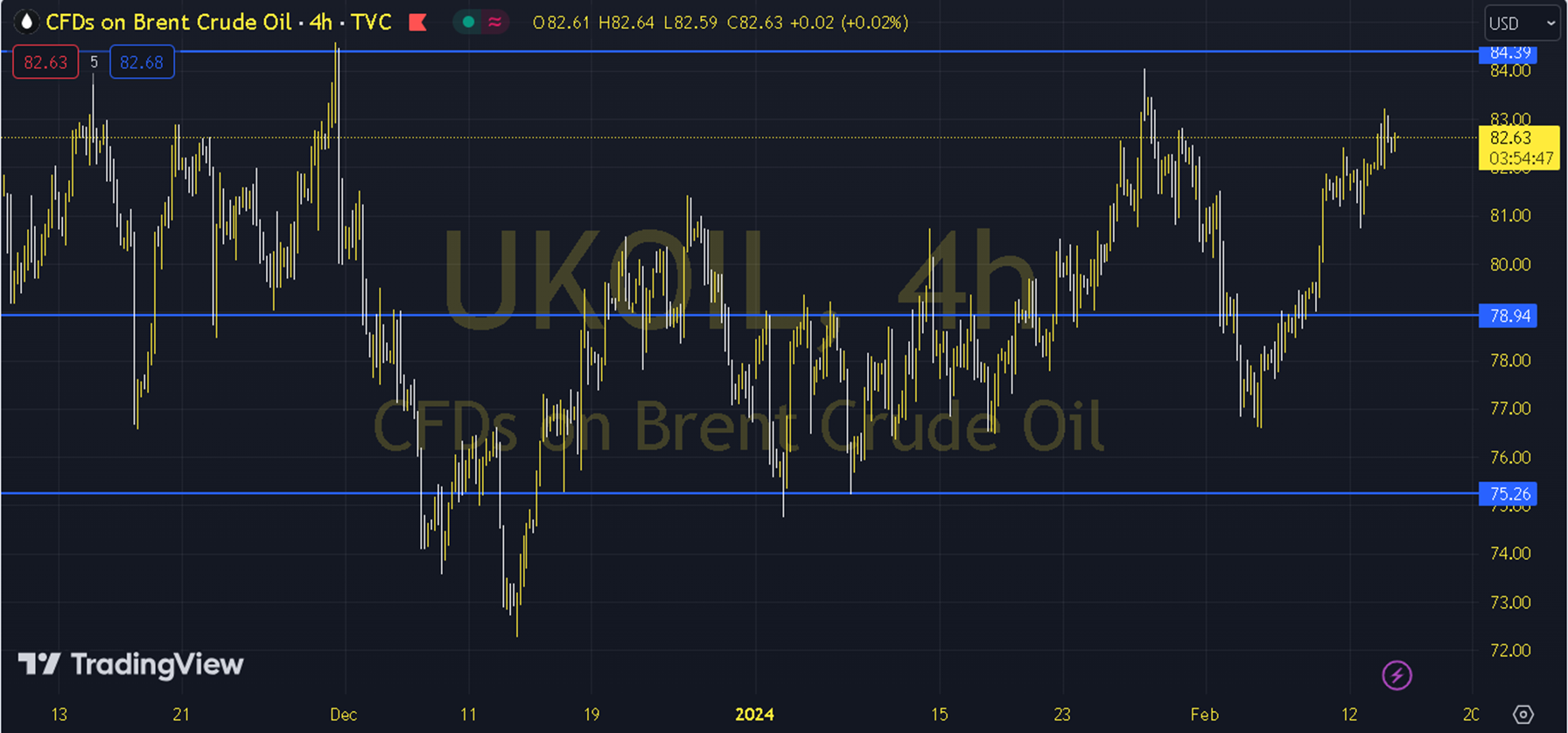

BRENT

Although the American Petroleum Institute's announcement of an 8.5 million barrel increase in stocks has caused some of the gains in oil futures to be returned, the overall upward outlook continues. Geopolitical risks are particularly at the forefront here. The course of European and US stock markets and the official stock figures to be announced by the US Energy Information Administration can be followed during the day. As long as pricing remains at and above the 81.50 - 82.00 support in the upcoming period, the upward outlook may be at the forefront. In possible increases, the 83.00 and 83.50 levels can be targeted. As long as possible decreases are limited to the 81.50 - 82.00 support, new upward potential may occur. Therefore, it may be necessary to see the course below 81.50 and hourly closings for the continuation of the downward desire. In this case, the 81.00 and 80.50 levels may come to the agenda. Support: 81.50 Resistance: 83.50