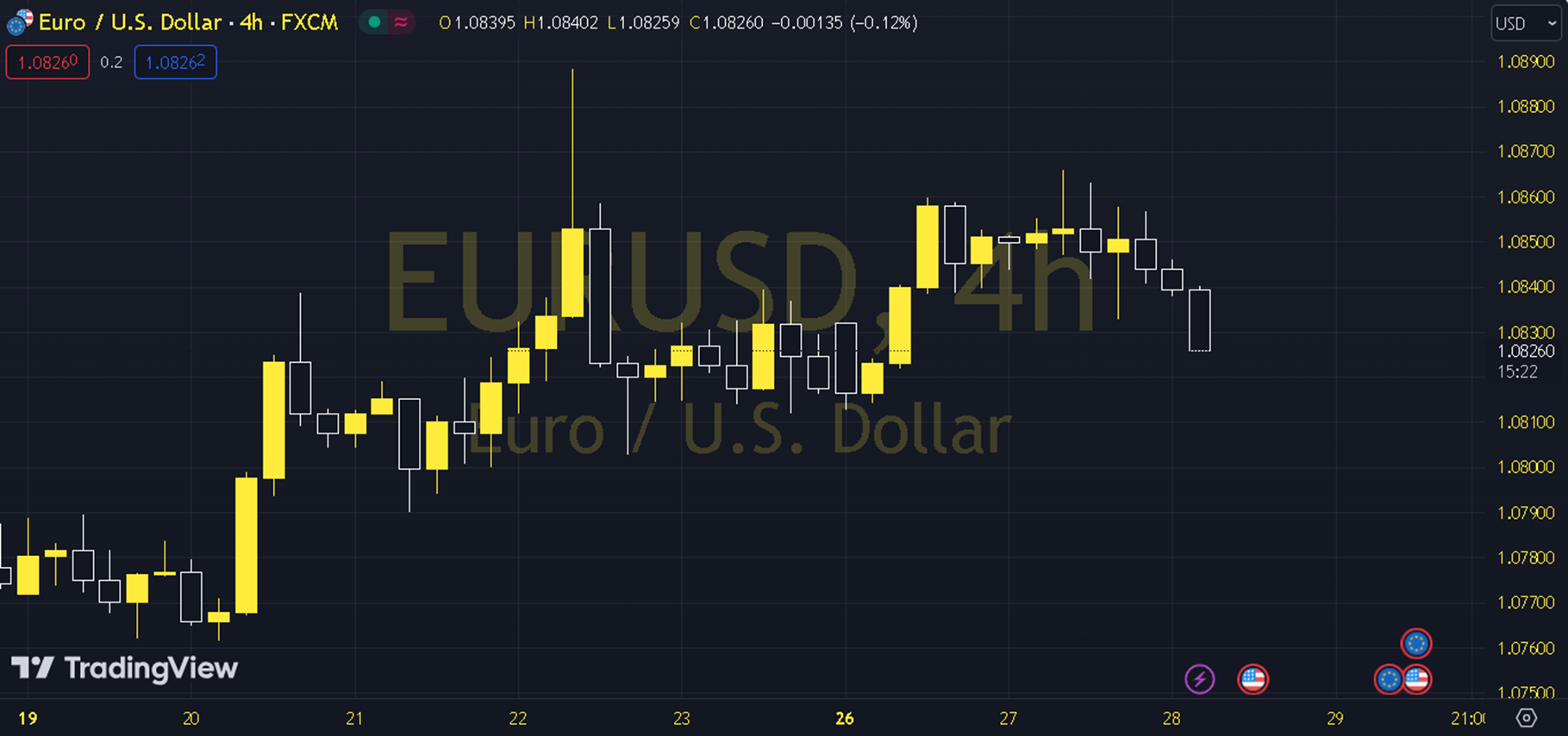

EURUSD

On the second trading day of the week for EURUSD, we observed short-term pressure on the EURUSD parity as the Classic Dollar Index continued to remain above the 34 and 100-day exponential moving averages (103.50) that we base it on. When we evaluate technically, the 1.0800 - 1.0815 region, where the 55-period exponential moving average is also located, is important, and the parity may want to adapt to its positive outlook on the relevant region. With this in mind, an increase towards the levels of 1.0855, 1.0895 and 1.0930 can be observed. Especially permanent movements above 1.0855 can further strengthen the current positive desire. Otherwise, pressure may occur towards the short-term indicator. It should not be forgotten that permanent movements below the 1.0800 - 1.0815 region are needed for this pressure and the current scenario to be invalidated. However, a new pricing reaction towards the 1.0695 bottom point can be observed under this condition. Support: 1.0815 – 1.0800 Resistance: 1.0855 – 1.0895