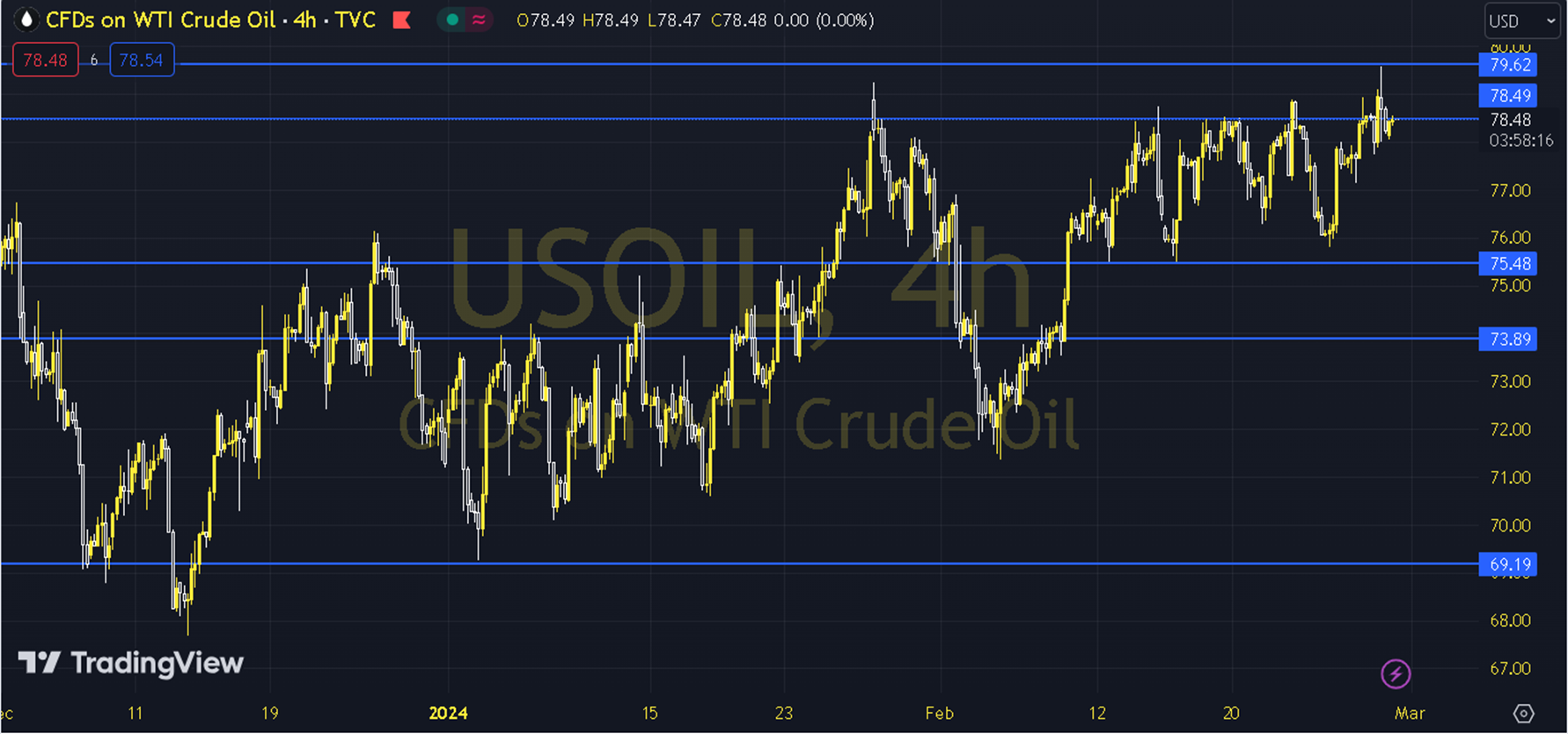

WTIUSD

Oil prices retreated after an effective increase yesterday with the scenario of supply tightening. We observed a recovery effort in the Asian session. The expectation that OPEC+ will implement the production cut decision in the second quarter of the year seems to have formed the basis for this scenario. The course of European and US stock markets and the PCE inflation data to be announced in the US can be followed during the day. As long as the pricing remains above the 77.50 - 78.00 support in the upcoming process, an upward outlook may be at the forefront. In possible increases, 79.00 and 79.50 levels can be targeted. In possible decreases, as long as the 77.50 - 78.00 support remains current, a new increase potential may occur. Therefore, it may be necessary to see the course below 75.50 and hourly closings for the continuation of the downward desire. In this case, the 77.00 level may come to the agenda. Support: 77.50 Resistance: 79.50