XAUUSD

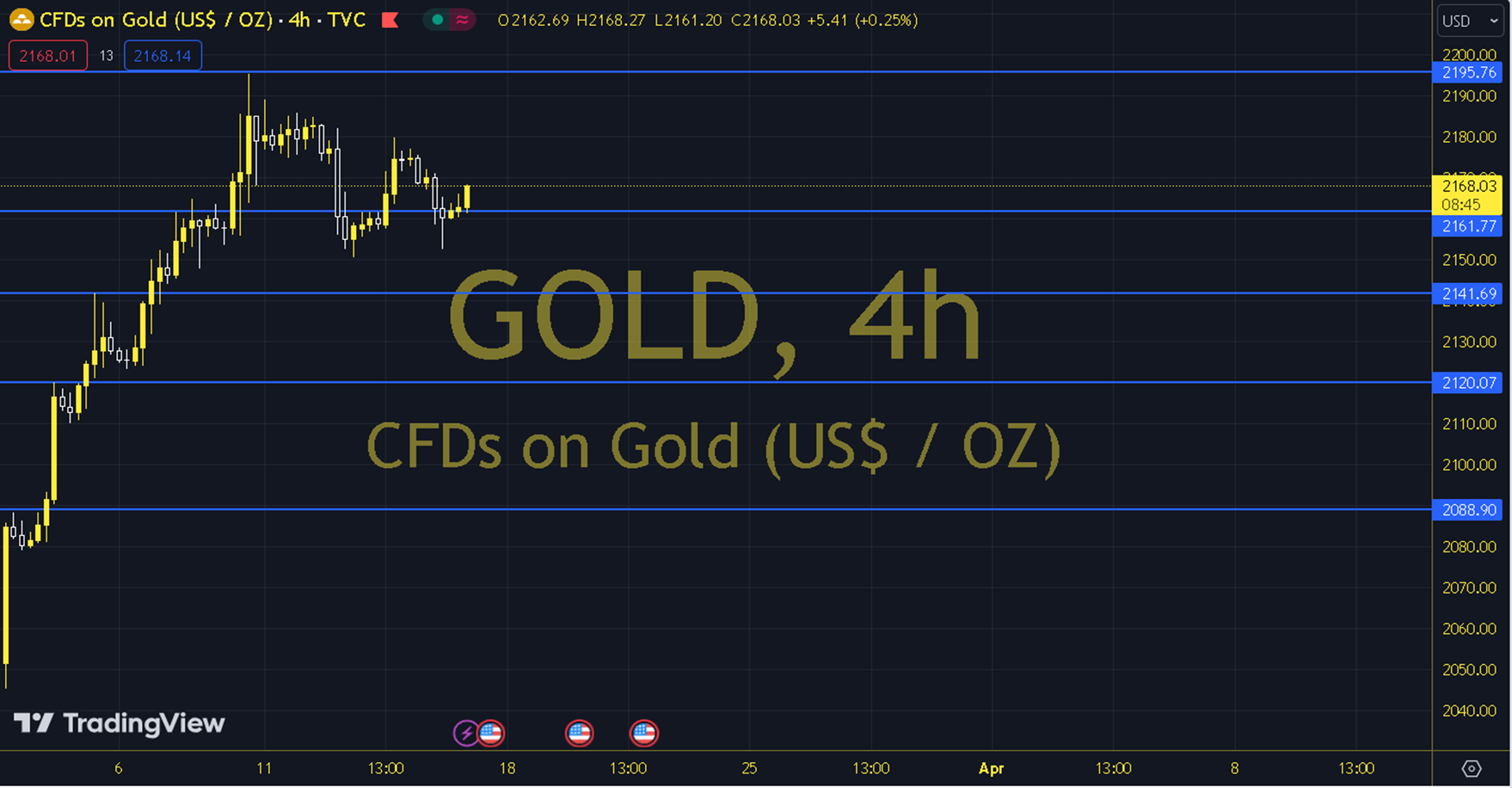

Following the US PPI data, due to the effect of the 10-year treasury bond yield rising towards 4.30%; ounce gold displayed limited pricing in the short term. During the day, the Empire State manufacturing index, industrial production, Michigan consumer sentiment and inflation expectations can be monitored due to their possible effects. When we evaluate the short-term ounce gold pricing technically, we are monitoring the 2150 - 2168 region, which is currently supported by the 13 (2165) and 34 (2159) period exponential moving average. In possible recoveries, 2175 and 2185 levels may come to the agenda. In the meantime, the attitude of the 2185 level can be monitored in order for the expectation of increase to continue. In order for the negative expectation to come to the fore, it may be necessary to remain below the 2150 level. In possible declines, 2144 and 2133 levels may be encountered. At this stage, the reaction of the 2144 level can be monitored in order for the withdrawal trend to continue. Support: 2157-2150 Resistance: 2175-2185