BRENT

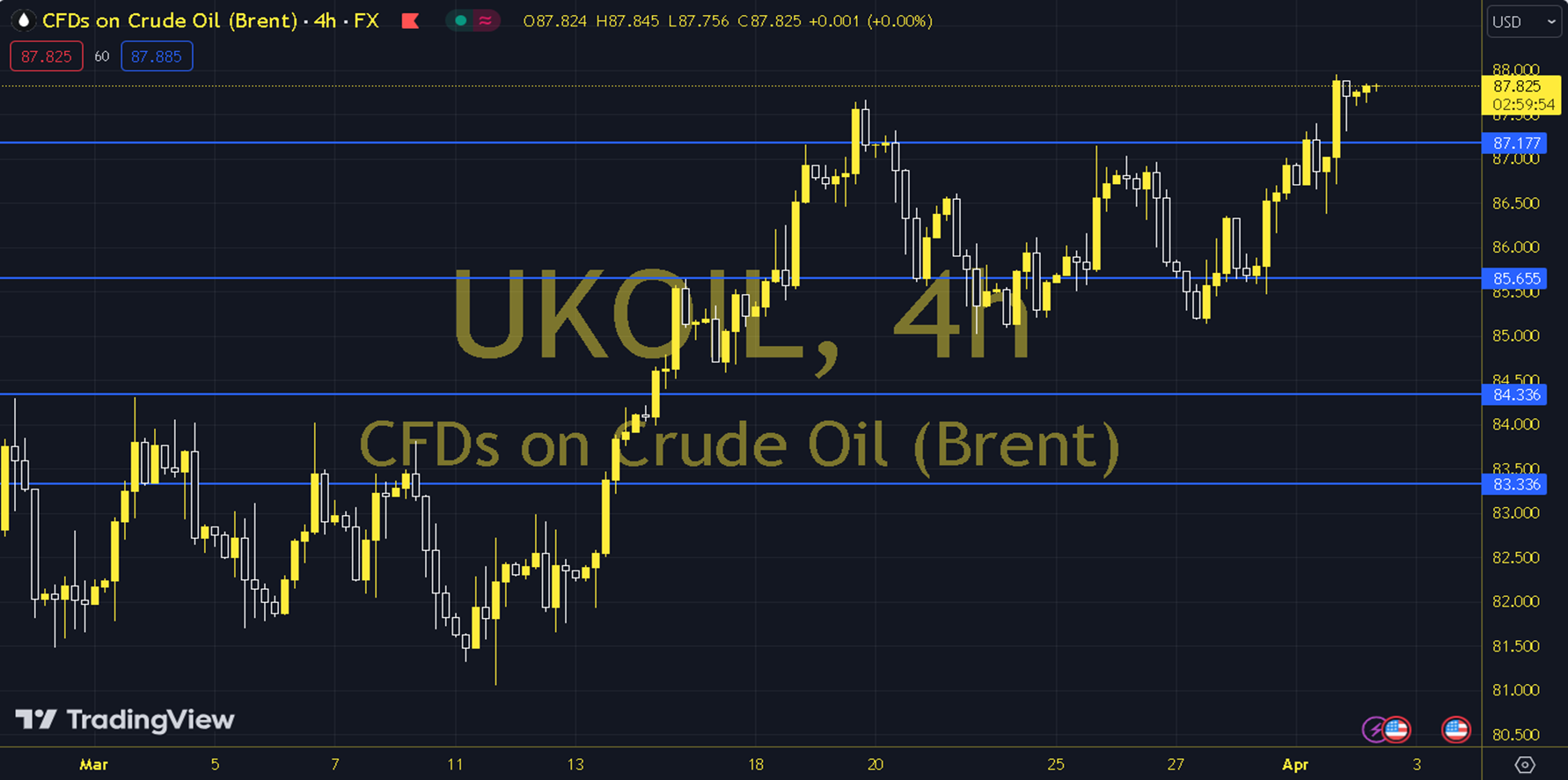

Oil prices rose due to increased geopolitical risk and the killing of a senior military commander in an airstrike by Israel on the Iranian embassy in Syria, and Iran's announcement that it would respond decisively to the attack. The course of European and US stock markets and the stock figures to be announced by the American Petroleum Institute can be followed during the day. As long as pricing remains at and above the 87.00 - 87.50 support level, an upward outlook may be at the forefront in the upcoming period. In possible increases, 88.50 and 89.00 levels may be targeted. In possible decreases, as long as the 87.00 - 87.50 support level remains current, a new uptrend may occur. Therefore, it may be necessary to see the course below 87.00 and 4-hour closings for the continuation of the downward trend. In this case, the 86.50 and 86.00 levels may come to the fore. Support: 87.50 - 87.00 Resistance: 88.50 - 89.00