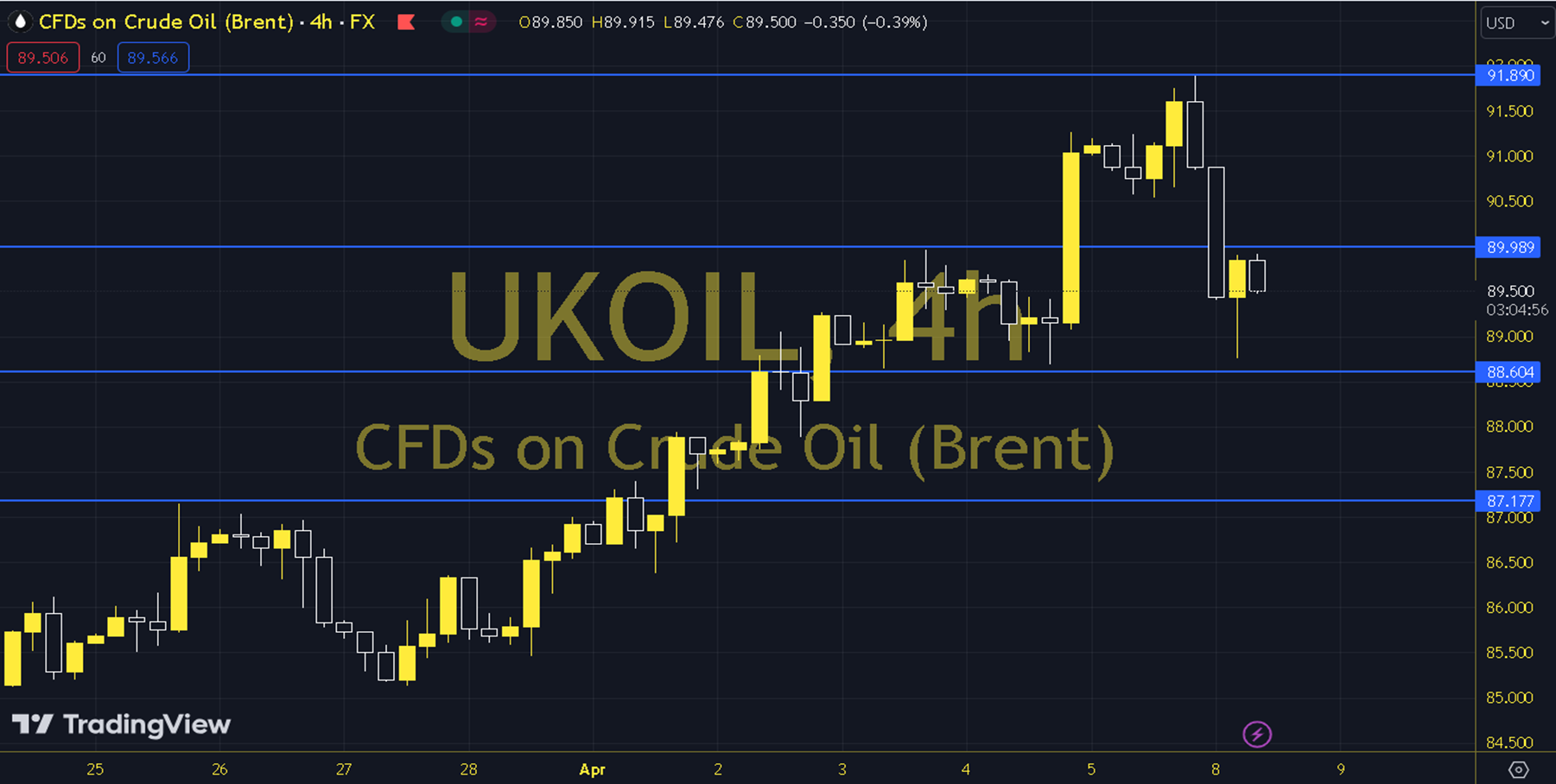

BRENT

Israel's announcement to withdraw some of its military force from Gaza was effective in starting the week with a pullback of over 1% in oil prices. However, the Israeli Defense Minister's statement that this was a tactical withdrawal seems to have limited hopes that the war is nearing an end for now. On the other hand, the expectation that Iran will still respond to the attack on its consulate in Syria keeps the risk alive. The course of European and US stock markets can be followed during the day. As long as pricing remains below the 90.00 - 90.50 resistance in the upcoming process, a downward view may be at the forefront. In possible declines, 89.00 and 88.50 levels can be targeted. In possible recoveries, as long as the 90.00 - 90.50 resistance remains current, a new downward potential may occur. Therefore, it may be necessary to see the course above 90.50 and hourly closings for the continuation of the upward desire. In this case, 91.00 and 91.50 levels may come to the agenda. Support: 89.00 – 88.50 Resistance: 90.00 – 90.50