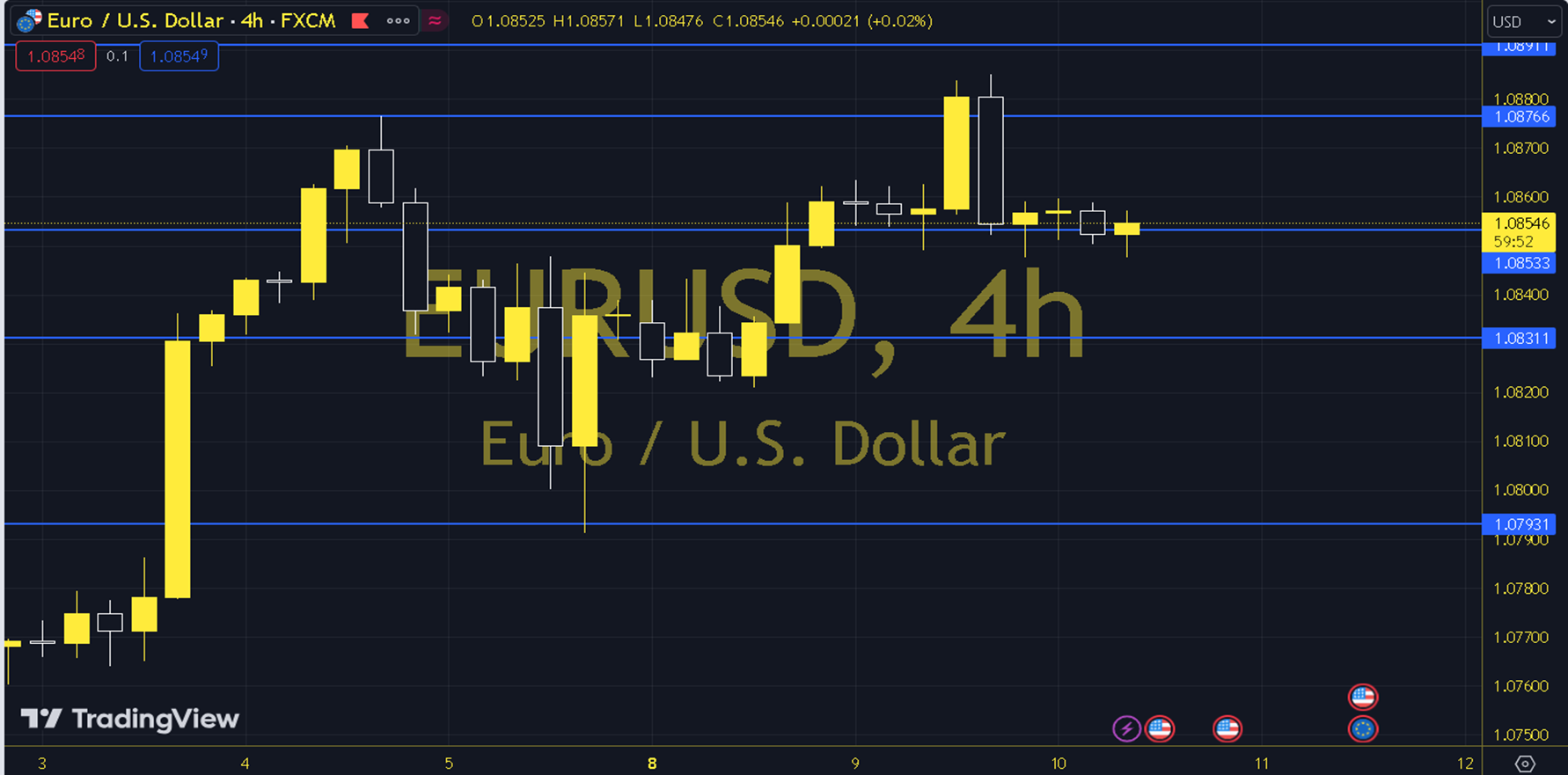

EURUSD

We are on the most important day of the week. Today, global markets will focus on the March Headline and Core CPI data from the US and the FOMC meeting minutes, which include the details of the March meeting. When we evaluate the EURUSD parity in the short term, the trend line created by the negative outlook starting from the 1.0965 - 1.1000 region is currently passing through the 1.0860 - 1.0895 region. With this in mind, a decline towards the supports of 1.0820, 1.0780 and 1.0740 can be observed. In particular, permanent movements below the 1.0820 level can strengthen the current pressure. Otherwise, a recovery towards the trend zone can be observed. In this process, whether the Dollar Index remains above the reference zone can be monitored as a roadmap for whether the EURUSD parity will continue its negative trend. Since permanent movements above 1.0895 in particular will be read as a trend change, the psychological 1.1000 level can be evaluated as the target area in the new outlook. Support: 1.0820 – 1.0780 Resistance: 1.0860 – 1.0895