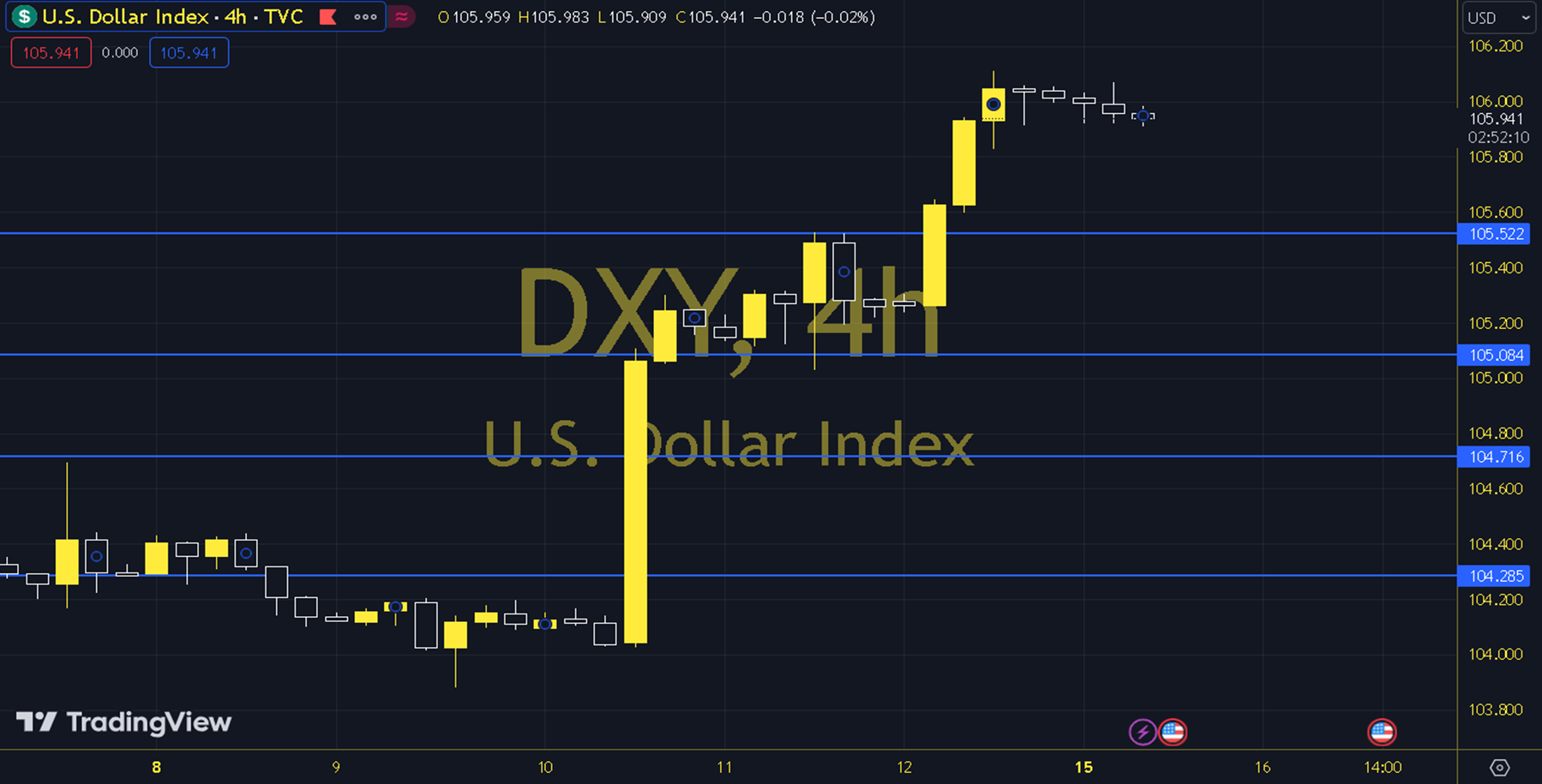

DXY

The US Dollar Index (DXY) rose above 106.00 for the first time this year, hitting a five-month high of 106.117. The DXY remains strong as the Fed can now keep interest rates on hold longer than other major central banks. The first level on the rise is 106.50, the high from November 10. Further up, the DXY could face resistance at 107.35, the high from October 3. On the downside, new support levels should be overcome and the Dollar Index could see itself hovering around the first significant psychological level of 105.50, briefly reverting below and above it. Further down, 104.60 should also act as support ahead of the area where the 55-day and 200-day Simple Moving Averages are located at 103.97 and 103.84, respectively. Support: 105,500-104,600 Resistance: 106,500-107,350