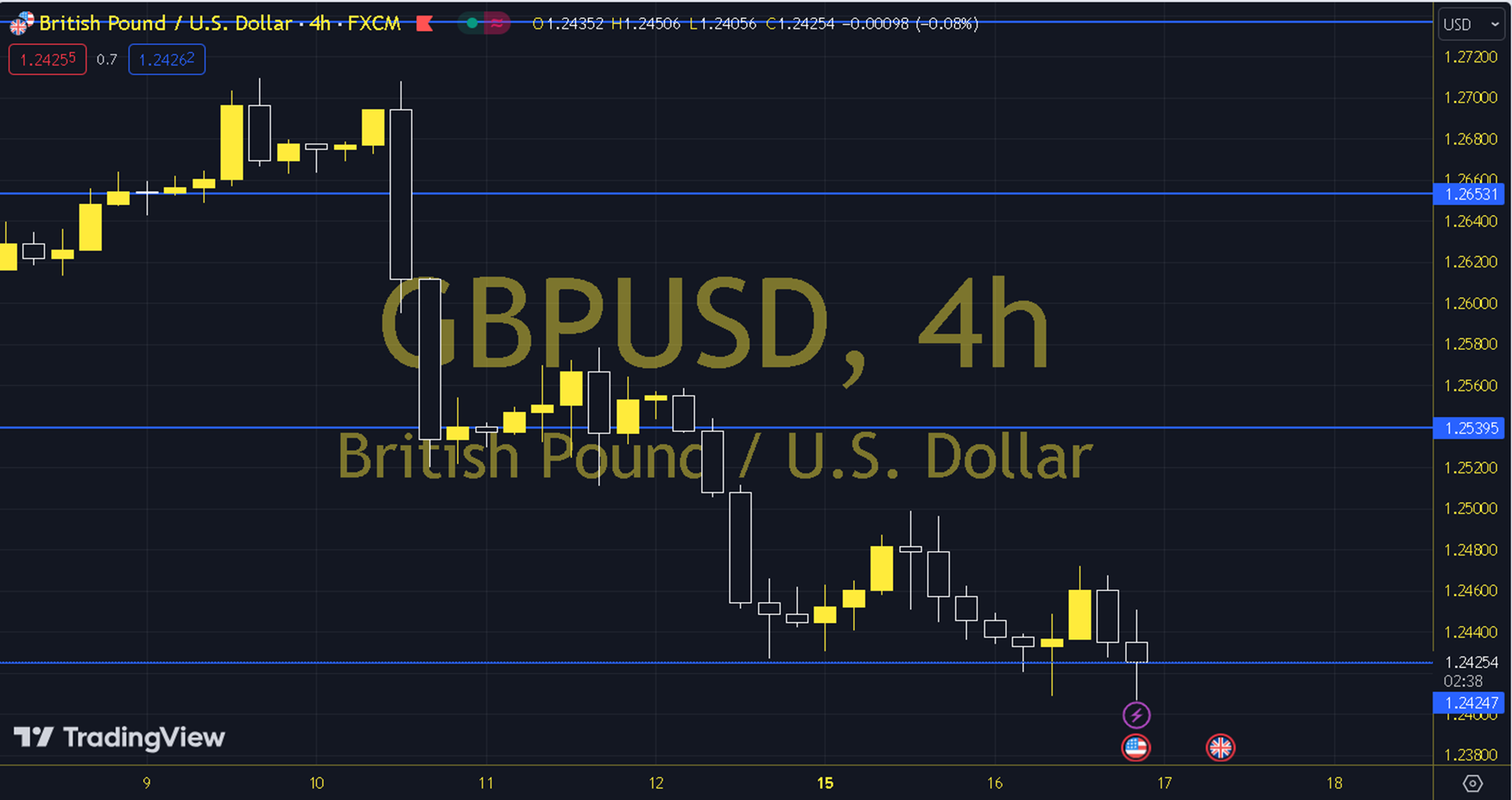

GBPUSD

The Classic Dollar Index is gradually continuing its upward trend that started last week with the US CPI data. When we reach the middle of the week, the UK and Eurozone CPI data and the speeches of ECB President Lagarde and BoE President Bailey can be followed regarding the macroeconomic developments that may affect the index and parity. Although the CPI data to come from the Eurozone will not create significant pressure on the index due to being final, the UK CPI data can be examined for the course of the index before the current talks on whether the BoE will postpone the interest rate cut after the Fed or whether the BoE will continue the interest rate cut tempo between the ECB and the Fed. The 1.2431 level can be followed in intraday upward movements. If this level is exceeded, the resistances of 1.2440, 1.2450 and 1.2459 may become important. In possible pullbacks, 1.2421, 1.2412 and 1.2402 will be monitored as support levels. Support: 1.2412 – 1.2402 Resistance: 1.2450 – 1.2459