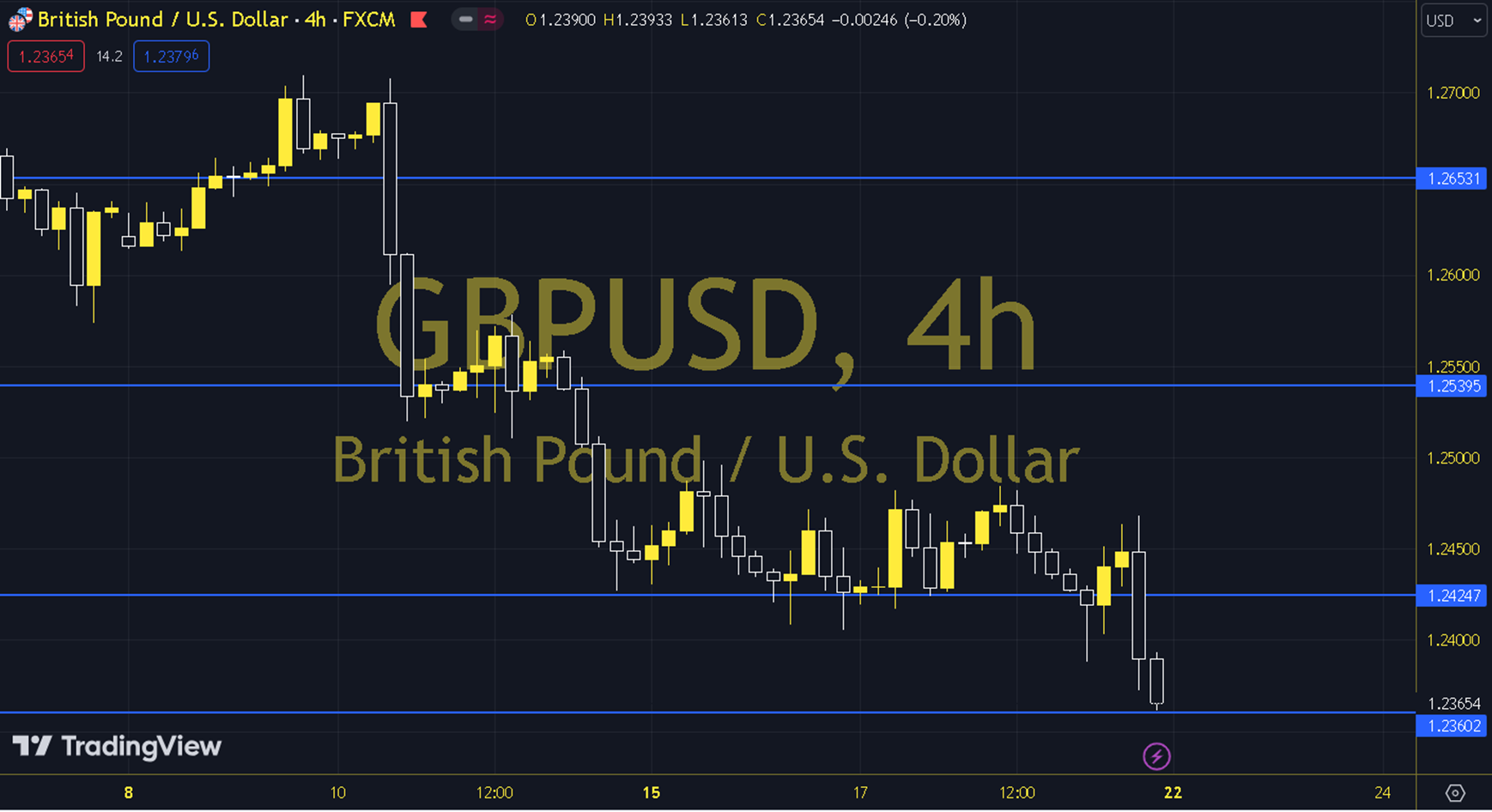

GBPUSD

This week, both the continuation of current geopolitical risks and expectations for central banks along with important economic indicators will be monitored. Before the official Fed meeting on May 1, the US Growth, Services PMI, PCE Inflation, Germany Manufacturing PMI, and the UK Services PMI data from the UK should be followed carefully for the course of the Dollar Index and GBPUSD parity. The classical Dollar Index continues its scenario of blinking at the level of 107 tested in October 2023 on the 34 and 100-day averages (103.90 - 104.32 region), while it also keeps the weak reaction / strong trend theme in the foreground with the desire to stay above 105.50. Whether the current scenario will continue this week is important for the course of the GBPUSD. The 1.2383 level can be followed in intraday downward movements. In case of falling below this level, the supports of 1.2372, 1.2355 and 1.2344 may become important. In possible increases, 1.2400, 1.2411 and 1.2427 will be monitored as resistance levels. Support: 1.2355 - 1.2344 Resistance: 1.2411 - 1.2427