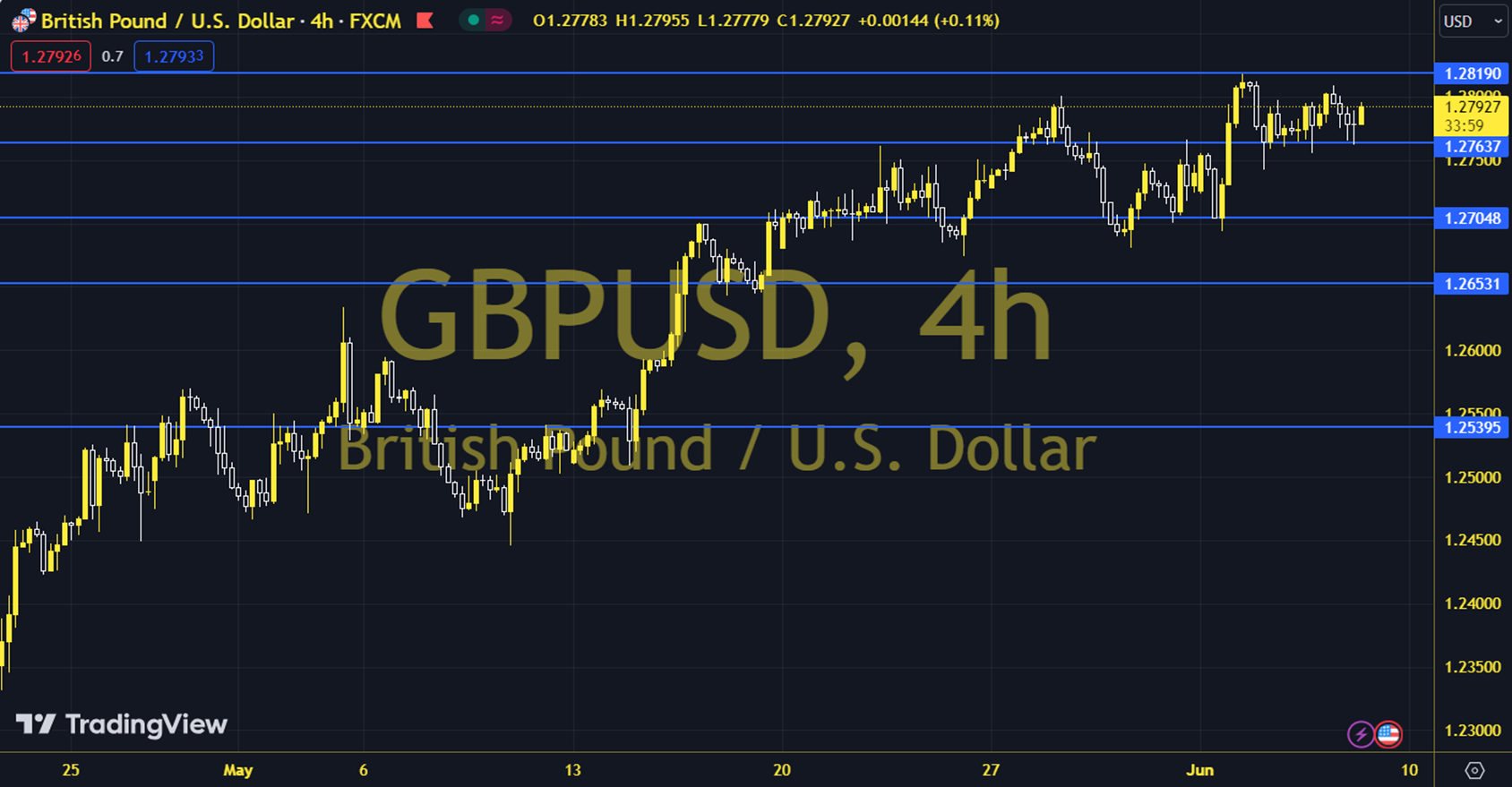

GBPUSD

Before June 12 US CPI, FOMC Economic Projections and Fed Chair Powell's speech, today's global markets are focusing on Nonfarm Payrolls, Unemployment Rate and Average Hourly Earnings/Income. While going through a critical process and following the interest rate cut step from SNB, BoC and then ECB, all eyes are on the strategy to be followed by the Fed. For this reason, the results of today's critical indicators should be followed carefully for instant pricing behavior before June 12 Fed. The daily loss for the parity, which closed at 1.2789 on the previous trading day, was 0.00%. The RSI indicator for the parity, which is below its 20-day moving average, is at 63.56, while its momentum is at 100.57. The 1.2789 level can be followed in intraday upward movements. If this level is exceeded, the resistances at 1.2796, 1.2802 and 1.2809 may become important. In case of possible pullbacks, 1.2776 and 1.2770 will be monitored as support levels. Support: 1.2776 – 1.2770 Resistance: 1.2796 – 1.2802