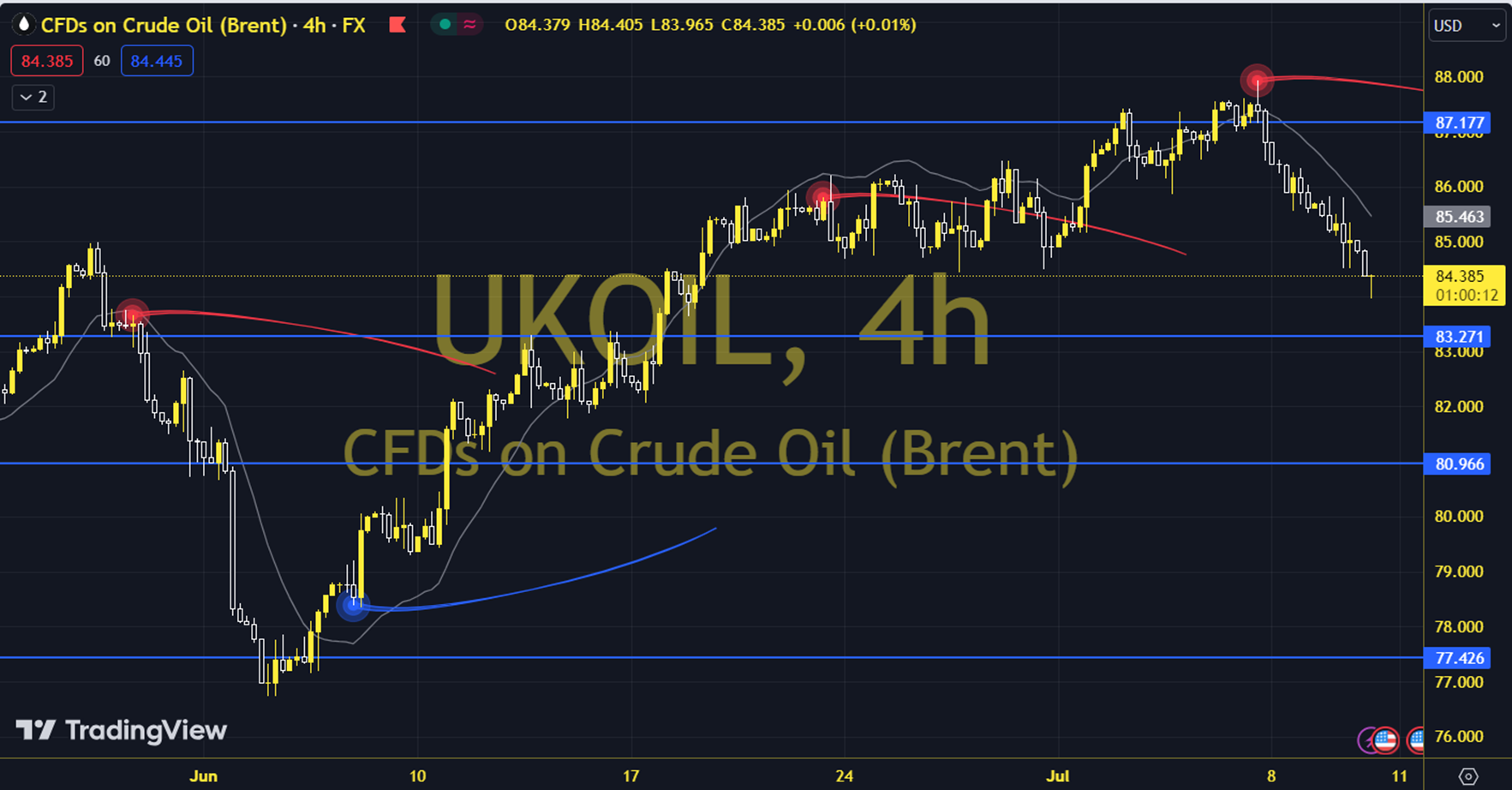

BRENT

Oil futures showed a recovery trend with the Energy Information Administration report showing that demand for oil derivatives gained strength during the July 4 holiday in the US. Gasoline demand is at its highest level since the pandemic, according to the 4-week average. The institution, which announced a 3.4 million barrel decrease in stocks yesterday, also showed that stocks in Cushing, a futures delivery center, reached their lowest levels in about 2.5 months. The course of European and US stock markets and US June inflation data can be followed during the day. Brent oil, which followed a buying course on the last trading day, gained 0.43% daily. The RSI indicator for the commodity, which is above its 20-day moving average, is at 52.10, while its momentum is at 99.61. The 85.10 level can be followed in intraday downward movements. If this level is broken, the supports at 84.58 and 83.92 may become important. In possible increases, the resistance levels of 86.57, 87.19 and 88.15 will be monitored. Support: 85.10 – 84.58 Resistance: 86.57 – 87.19