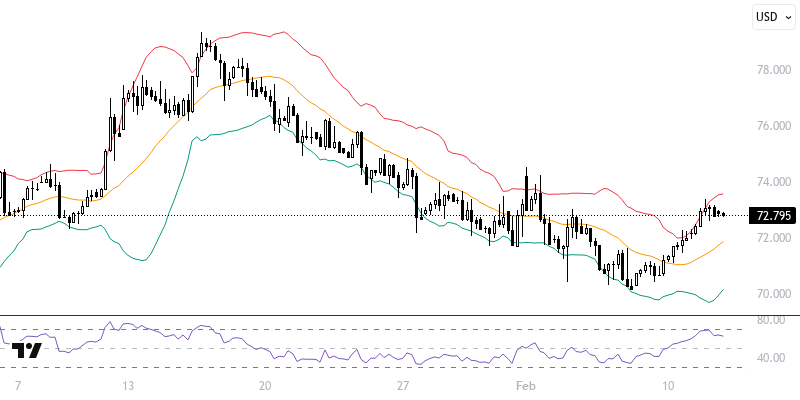

WTIUSD

Crude oil futures started the week with a decline. The American Petroleum Institute reported a 9 million barrel increase in stocks. If this figure is confirmed by the stock data to be released today by the U.S. Energy Information Administration, it will mark the fastest two-week stock increase in nearly a year. Supply concerns regarding Russia and Iran are among the significant factors limiting the price decline. Throughout the day, stock data and U.S. inflation figures may be closely monitored.

As long as prices remain above the support level of 72.50 – 73.00, an upward trend may be observed. In potential rallies, the levels of 73.50 and 74.00 could be targeted. However, as long as the 72.50 – 73.00 support holds, new upward potential may arise. To maintain the downward pressure, movements and hourly closings below 72.50 need to be monitored; in this case, the levels of 72.00 and 71.50 may come into play.

Support :

Resistance :