NDXUSD

Fed Chair Powell emphasized in his statements that they will not rush to lower interest rates. He warned that a rapid easing of policy could lead to a loss of control over inflation, while moving slowly could negatively affect economic growth. This situation caused the 10-year bond yields to rise above 4.55% and put pressure on gains in the S&P 500 Index. Throughout the day, CPI data and Powell's statements will be closely monitored.

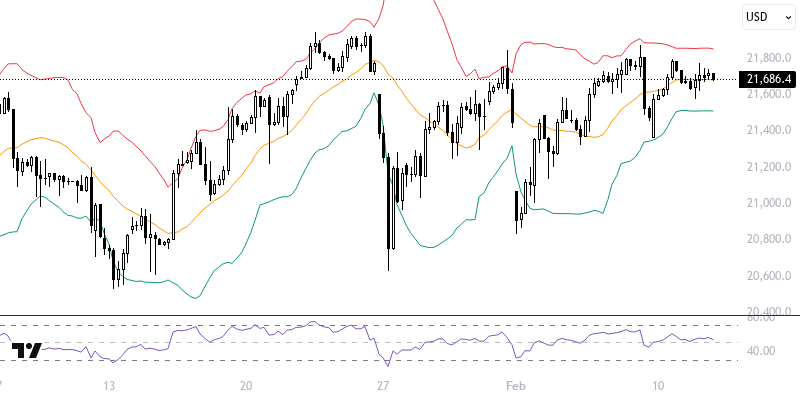

The NASDAQ 100 index is trading above supportive indicators. In short-term pricing, as long as it remains above the 21 and 233-period exponential moving averages supporting the 21,500 – 21,700 range, the upward momentum may continue. If positive movements persist, there could be room for movement towards the 21,820 and 21,900 levels. For a desire to decline, however, there will need to be sustained pricing below the 21,500 – 21,700 range.

Support :

Resistance :