GBPUSD

In the U.S., the annual headline inflation rate reached 3.00%, while a 3.30% increase in core inflation caused significant fluctuations in the markets. During this process, expectations for a Fed interest rate cut shifted to October. The rise of the Dollar Index and pressure on stock indices affected market dynamics, while Fed Chairman Powell stated they are close to their inflation targets. However, he emphasized that they would not rush into cutting interest rates.

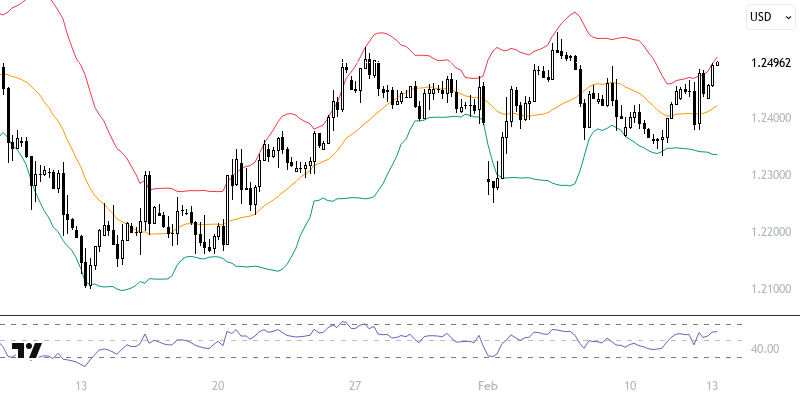

The GBPUSD pair is currently trading above the 144 and 233-period moving averages with recent movements. The pair's performance above the 1.2415 – 1.2450 range is crucial for a new positive outlook. If it manages to stay above this level, there may be room for movement towards 1.2615. However, sustained movements below the 1.2415 – 1.2450 range could trigger a resumption of the negative trend. Key levels to watch today are 1.2415 and 1.2525.

Support :

Resistance :