DAXEUR

In the United States, the annual headline CPI reached 3.00%, while the core CPI hit 3.30%, exceeding market expectations. Although this situation caused a temporary pressure on global stock indices, a normalization was observed in the markets afterward, and losses were compensated. The DAX40 index displayed a remarkable trend, reassessing peak levels alongside an upward trend. Today's economic calendar is expected to include the fourth-quarter growth data from the UK, CPI data from Germany and Switzerland, and PPI data from the US.

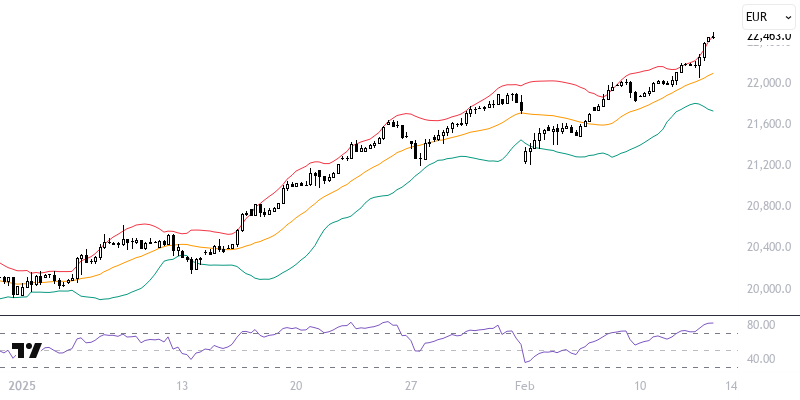

When technically analyzing the DAX40 index, the level of 22,100, where the 21-period moving average is located, stands out as a critical threshold. As long as the index manages to stay above this average, it could move towards the levels of 22,555, 22,650, and 22,775. Sustained movements above the first upper region of the Envelope indicators at 22,555 could support the continuation of the rally. However, if pressure occurs below this level, it should be noted that even if the index falls below the 21-period average, the 55-period average is likely to remain positive above 21,850. Key levels: 22,100 and 22,555.

Support :

Resistance :