GBPUSD

The ongoing overall optimism, sustained above the 233-day exponential moving average (105.15), strengthens short-term reaction expectations as the Classic Dollar Index trades below the 34-day average (107.60). Recent movements support this situation and set the stage for the index to target the 106.50 level. As we enter the new week, U.S. stock markets are closed due to Presidents' Day, while Fed officials Harker and Bowman, along with Bundesbank President Nagel, are scheduled to speak as part of the data flow.

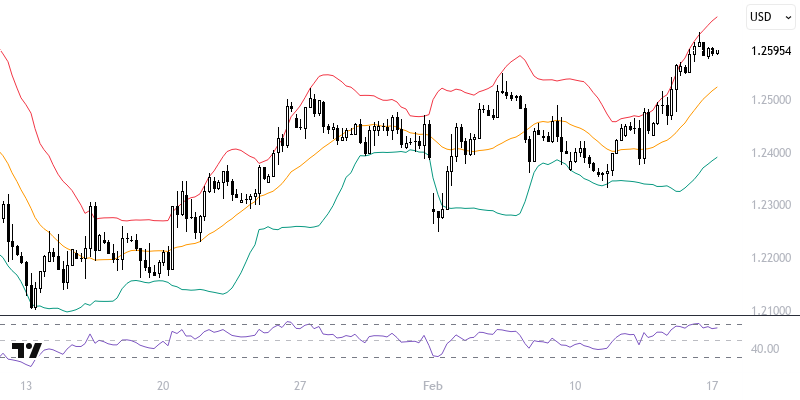

The GBPUSD pair continues its movement in the 1.2435 – 1.2460 range, where the 144 and 233-period averages are located, due to reaction sell-offs in the DXY. This could create room for movement towards the 1.2715 level. The 1.2615 level is a critical threshold regarding whether the upward trend will continue or whether there will be pressure towards the averages. In the event of such pressure, sustained movements below the averages will be required for the pair to return to its negative trend.

Support :

Resistance :