DAXEUR

As Europe's political calendar and Trump's potential tariffs create pressure on the global economic outlook, European stock indices are showing a positive divergence. Indices from countries like Germany, France, Italy, and Spain have exhibited double-digit positive performance since the beginning of the year. While thoughts of a possible correction are on the agenda, there has not yet been a signal from the pricing side. Additionally, the closure of U.S. stock markets due to Presidents' Day may further highlight Europe's internal dynamics.

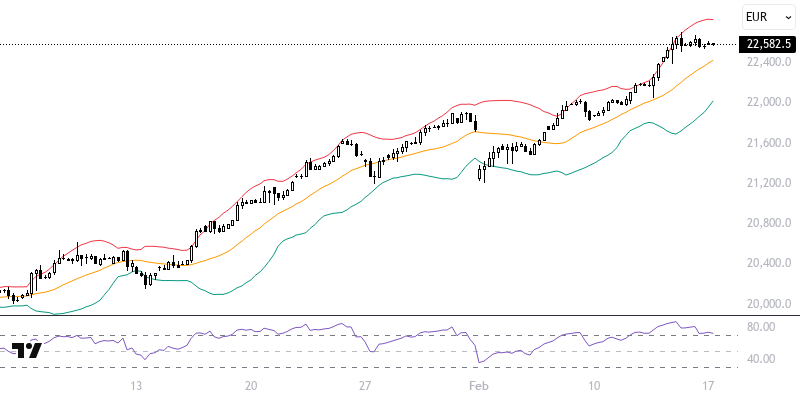

The technical analysis of the DAX40 index indicates that the level of 22405, where the 21-period average lies, is critical. The index continues to stay above this average and could move towards the levels of 22680, 22810, and 22920. Particularly, sustained movements above 22810 could gain momentum for a rally, while any pressure towards the average would make it essential to maintain the 55-period average above the level of 22070. The critical levels for the day are identified as 22405 and 22810.

Support :

Resistance :