EURUSD

Despite the reaction starting from the 110 level, we indicated that the medium-term outlook for the Classic Dollar Index remains optimistic. In the weekly bulletin, we emphasized the critical importance of the range between 106.45 and 105.70, where the 21-week average is located. The rebound following the index reaching the 106.45 level reinforces the thought that the correction has ended. In this context, we will monitor whether the index can maintain this critical area for the remainder of the week. This will also be a significant determinant of whether the upward trends in the EURUSD and GBPUSD pairs have come to an end.

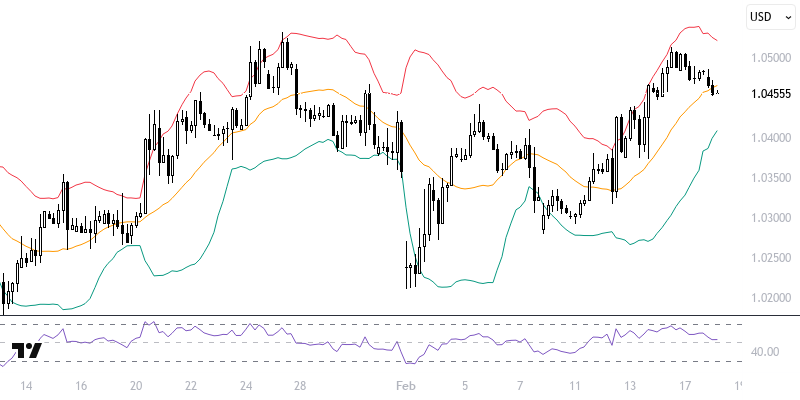

The EURUSD pair faced pressure after slightly exceeding the 1.05 level due to the recovery in the DXY. If a reversal occurs in the DXY, it should be noted that downward pressure on the pair may be anticipated. Technically, for this pressure to materialize, sustained movements below the 1.0405 – 1.0430 region, where the 55 and 233-period averages are located, are required. However, since there hasn't been a breakout yet, it is important to remember that the positive trend continues. Therefore, we will expect consistency above the 1.0480 level for the positive movement to persist.

Support :

Resistance :