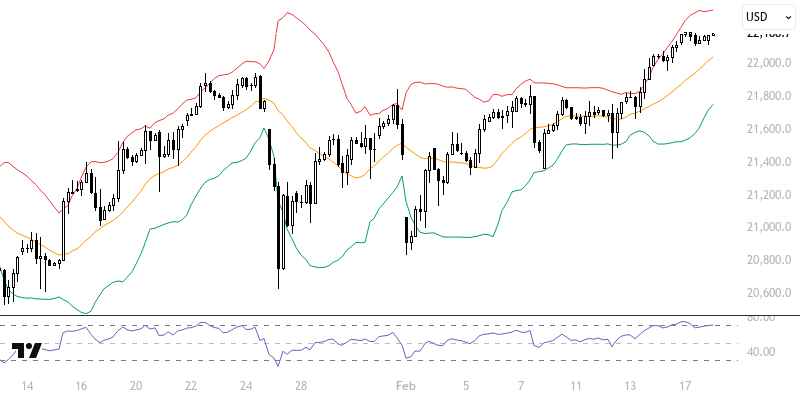

NDXUSD

The fact that the US 10-year Treasury yield remains around 4.50% allows the NASDAQ 100 Index to maintain its horizontal movements in the short term. In the spot market that will open after the holiday, a limited desire for an increase in futures contracts is observed. The NY Fed Empire State manufacturing index will be monitored throughout the day.

The NASDAQ 100 index is trading above critical levels supported by the indicators we are following. In short-term technical assessments, as long as it stays above the 22100 – 22200 range, supported by the 21-period exponential moving average, the desire for an increase may continue. If positive movements persist, it could gain momentum towards the 22375 and 22450 levels. However, for the desire to decline to be effective, permanent pricing must be seen in the 22100 – 22200 range. In this case, the 22000 and 21900 levels may come into play. Important Level: 22100 – 22200 range.

Support :

Resistance :