EURUSD

We have entered an important phase in global markets. While inflation, employment, and growth dynamics influence central bank decisions, a volatile process in asset prices is expected. This week, the European Central Bank's interest rate decision and President Lagarde's statements for the Eurozone will be closely watched, along with the ISM Manufacturing and Services PMI data in the U.S. Additionally, the Consumer Price Index (CPI) from the Eurozone and the ISM Manufacturing PMI data from the U.S. will also be monitored carefully.

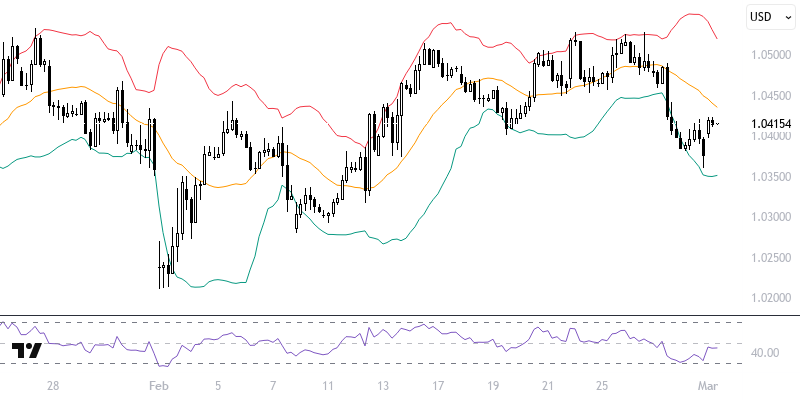

In the foreign exchange markets, the Dollar Index sustains its optimism by remaining above the 233-day exponential moving average. The EUR/USD pair is forming a new pattern below the levels of 1.0425 – 1.0442. Remaining below 1.0470 could bring the support levels of 1.0375 and 1.0330 into focus. Persistent movements below these levels may prompt attention towards the 1.0175 low, while averages will act as resistance in the event of a possible recovery.

Support :

Resistance :