GBPUSD

Significant developments are occurring in global markets. Speculative forecasts regarding inflation, employment, and growth dynamics are influencing central bank decisions and causing fluctuations in asset prices. This week, the European Central Bank's interest rate decision and President Lagarde's speech in the Eurozone, along with important data such as the ISM Manufacturing and Services PMIs in the U.S., will be closely monitored. Additionally, employment data from the U.S. and comments from Fed Chairman Powell are also key agenda items.

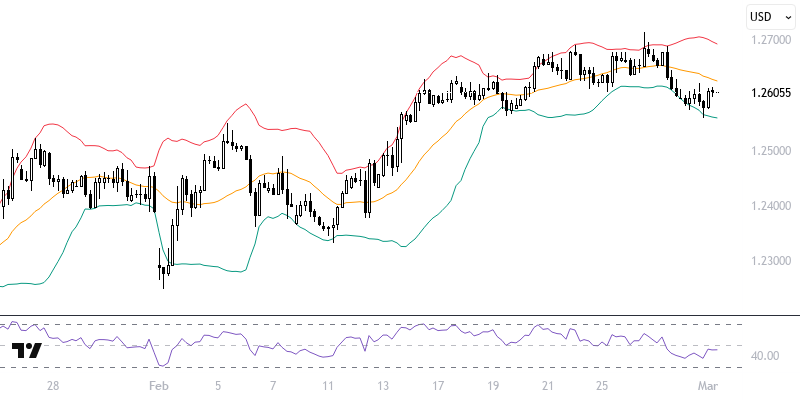

While the Dollar Index continues to stay above the 233-day exponential moving average, the GBPUSD pair has declined to the 1.2570 support level. The 1.2525 - 1.2570 zone is critical for maintaining positive expectations. Establishing stability in this area could support an upward trend towards the 1.2715 level. Prices above 1.2620 may further strengthen this positive outlook.

Support :

Resistance :