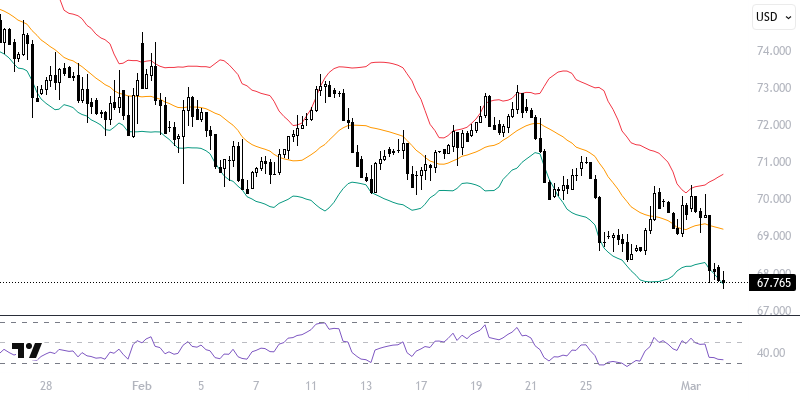

WTIUSD

Oil futures began to decline following President Trump's pressures that led OPEC+ to decide to gradually increase production in April. The initial step of the 2.2 million barrels per day production cut will be an increase of daily production by 138,000 barrels. Additionally, the pressure from tariffs in global trade is another significant factor affecting prices. However, developments regarding Ukraine and Russia, particularly the diminishing likelihood of a ceasefire agreement, are among the factors limiting the declines. It may be beneficial to monitor the situation in European and U.S. markets throughout the day.

As long as prices remain below the resistance levels of 68.50 – 69.00, a downward trend may prevail. If declines occur, targets could be set at 67.50 and 67.00 levels. In potential recoveries, maintaining the resistance at 68.50 – 69.00 could raise the possibility of new downward potential. Therefore, for the continuation of upward momentum, it is essential to track movements above 69.00 and consider hourly closings. In this case, the levels of 69.50 and 70.00 could come into play.

Support :

Resistance :