NDXUSD

On Monday, President Trump announced that the 25% tariff on Mexico and Canada has come into effect. He also announced that tariffs on China will be raised to 20%. It was stated that a retaliatory measure will be taken against countries imposing tariffs on the U.S. on April 2, raising inflationary concerns and increasing risk perception. Despite the decline in U.S. 10-year Treasury yields, the NASDAQ100 index experienced downward pricing influenced by the semiconductor sector. Nvidia attracted attention with an 8.69% drop in the spot market.

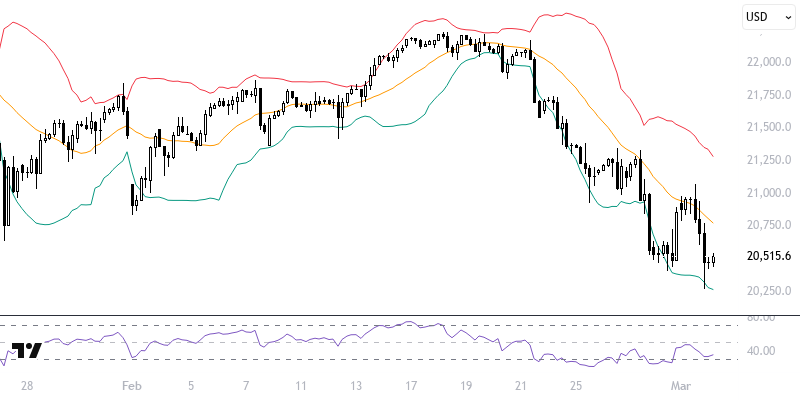

The NASDAQ100 index is trading below the area supported by the indicators we are monitoring. When evaluating short-term pricing technically, support from the 21-period exponential moving average around the 20785 – 20900 region could suppress upward movement and prolong the downward trend. If declines continue, a movement towards the 20420 and 20250 supports may occur. The condition of the 20420 – 20520 range is critical for the continuation of downward expectations. For upward pricing to occur, 4-hour closes above 20900 will be necessary, with resistance levels at 20975 and 21100 to be monitored. The key level of the day: 20785 – 20900 region.

Support :

Resistance :