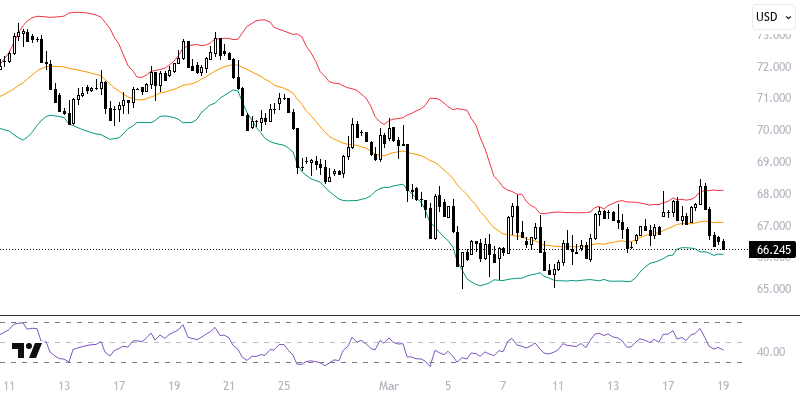

WTIUSD

Oil futures fell following an agreement between Trump and Putin to halt energy and infrastructure attacks in Ukraine. However, Russia rejected the 30-day ceasefire. While this development brings Russia closer to the global market, it is viewed as a pressure factor in the markets. Additionally, the American Petroleum Institute reported a 4.6 million barrel increase in stockpiles, which also played a significant role. Today's stock data from the U.S. Energy Information Administration and the Fed's monetary policy statement will be closely monitored.

As long as pricing remains below the 67.00 – 67.50 resistance, a bearish trend may emerge. In potential declines, levels of 66.00 and 65.50 can be targeted. Furthermore, unless the 67.00 – 67.50 resistance is surpassed, new downward potential may arise. For upward movement, movements and hourly closes above 67.50 should be observed; in this case, the 68.00 level may come into focus.

Support :

Resistance :